Request For Reconsideration

Download a blank fillable Request For Reconsideration in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Request For Reconsideration with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

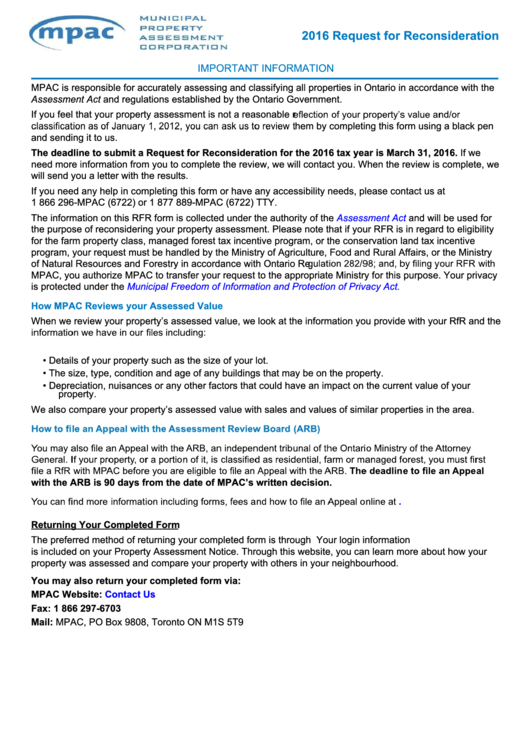

2016 Request for Reconsideration

IMPORTANT INFORMATION

MPAC is responsible for accurately assessing and classifying all properties in Ontario in accordance with the

Assessment Act and regulations established by the Ontario Government.

If you feel that your property assessment is not a reasonable r

hem by completing this form using a black pen

and sending it to us.

The deadline to submit a Request for Reconsideration for the 2016 tax year is March 31, 2016. If we

need more information from you to complete the review, we will contact you. When the review is complete, we

will send you a letter with the results.

If you need any help in completing this form or have any accessibility needs, please contact us at

1 866 296-MPAC (6722) or 1 877 889-MPAC (6722) TTY.

The information on this RFR form is collected under the authority of the

Assessment Act

and will be used for

the purpose of reconsidering your property assessment. Please note that if your RFR is in regard to eligibility

for the farm property class, managed forest tax incentive program, or the conservation land tax incentive

program, your request must be handled by the Ministry of Agriculture, Food and Rural Affairs, or the Ministry

of Natural Resources and Forestry in accordance with Ontario Re

MPAC, you authorize MPAC to transfer your request to the appropriate Ministry for this purpose. Your privacy

is protected under the

Municipal Freedom of Information and Protection of Privacy Act.

How MPAC Reviews your Assessed Value

When we review your property’s assessed value, we look at the information you provide with your RfR and the

•

Details of your property such as the size of your lot.

•

The size, type, condition and age of any buildings that may be on the property.

•

Depreciation, nuisances or any other factors that could have an impact on the current value of your

property.

We also compare your property’s assessed value with sales and values of similar properties in the area.

with the ARB is 90 days from the date of MPAC’s written decision.

elto.gov.on.ca.

Returning Your Completed Form

The preferred method of returning your completed form is through

aboutmyproperty.ca.

Your login information

is included on your Property Assessment Notice. Through this website, you can learn more about how your

property was assessed and compare your property with others in your neighbourhood.

You may also return your completed form via:

MPAC Website:

Contact Us

Fax:

1 866 297-6703

Mail:

MPAC, PO Box 9808, Toronto ON M1S 5T9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Medical

1

1 2

2 3

3 4

4