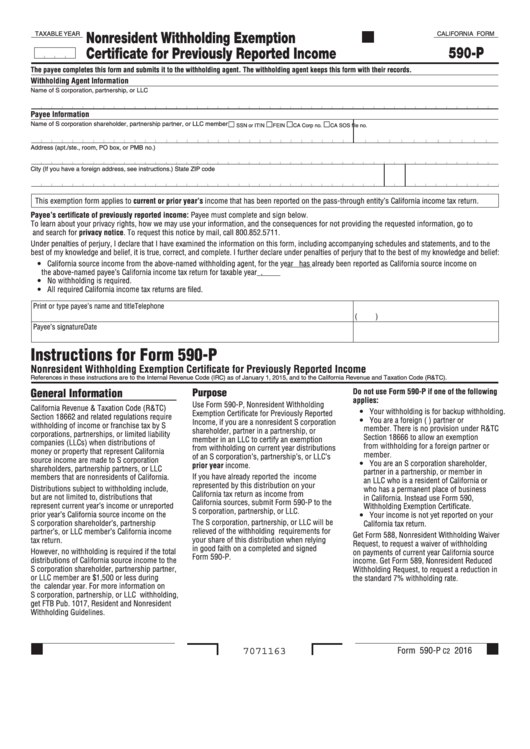

California Form 590-P - Nonresident Withholding Exemption Certificate For Previously Reported Income

ADVERTISEMENT

Nonresident Withholding Exemption

TAXABLE YEAR

CALIFORNIA FORM

590-P

Certificate for Previously Reported Income

The payee completes this form and submits it to the withholding agent. The withholding agent keeps this form with their records.

Withholding Agent Information

Name of S corporation, partnership, or LLC

Payee Information

Name of S corporation shareholder, partnership partner, or LLC member

SSN or ITIN

FEIN

CA Corp no.

CA SOS file no.

Address (apt./ste., room, PO box, or PMB no.)

City (If you have a foreign address, see instructions.)

State

ZIP code

This exemption form applies to current or prior year’s income that has been reported on the pass-through entity’s California income tax return.

Payee’s certificate of previously reported income: Payee must complete and sign below.

To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested information, go to

ftb.ca.gov and search for privacy notice. To request this notice by mail, call 800.852.5711.

Under penalties of perjury, I declare that I have examined the information on this form, including accompanying schedules and statements, and to the

best of my knowledge and belief, it is true, correct, and complete. I further declare under penalties of perjury that to the best of my knowledge and belief:

y California source income from the above-named withholding agent, for the year

has already been reported as California source income on

the above-named payee’s California income tax return for taxable year

.

y No withholding is required.

y All required California income tax returns are filed.

Print or type payee’s name and title

Telephone

(

)

Payee’s signature

Date

Instructions for Form 590-P

Nonresident Withholding Exemption Certificate for Previously Reported Income

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and to the California Revenue and Taxation Code (R&TC).

General Information

Purpose

Do not use Form 590-P if one of the following

applies:

Use Form 590-P, Nonresident Withholding

California Revenue & Taxation Code (R&TC)

y Your withholding is for backup withholding.

Exemption Certificate for Previously Reported

Section 18662 and related regulations require

y You are a foreign (non-U.S.) partner or

Income, if you are a nonresident S corporation

withholding of income or franchise tax by S

member. There is no provision under R&TC

shareholder, partner in a partnership, or

corporations, partnerships, or limited liability

Section 18666 to allow an exemption

member in an LLC to certify an exemption

companies (LLCs) when distributions of

from withholding for a foreign partner or

from withholding on current year distributions

money or property that represent California

member.

of an S corporation’s, partnership’s, or LLC’s

source income are made to S corporation

y You are an S corporation shareholder,

prior year income.

shareholders, partnership partners, or LLC

partner in a partnership, or member in

If you have already reported the income

members that are nonresidents of California.

an LLC who is a resident of California or

represented by this distribution on your

Distributions subject to withholding include,

who has a permanent place of business

California tax return as income from

but are not limited to, distributions that

in California. Instead use Form 590,

California sources, submit Form 590-P to the

represent current year’s income or unreported

Withholding Exemption Certificate.

S corporation, partnership, or LLC.

prior year’s California source income on the

y Your income is not yet reported on your

The S corporation, partnership, or LLC will be

S corporation shareholder’s, partnership

California tax return.

relieved of the withholding requirements for

partner’s, or LLC member’s California income

Get Form 588, Nonresident Withholding Waiver

your share of this distribution when relying

tax return.

Request, to request a waiver of withholding

in good faith on a completed and signed

However, no withholding is required if the total

on payments of current year California source

Form 590-P.

distributions of California source income to the

income. Get Form 589, Nonresident Reduced

S corporation shareholder, partnership partner,

Withholding Request, to request a reduction in

or LLC member are $1,500 or less during

the standard 7% withholding rate.

the calendar year. For more information on

S corporation, partnership, or LLC withholding,

get FTB Pub. 1017, Resident and Nonresident

Withholding Guidelines.

Form 590-P

2016

7071163

C2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1