Use Tax Return

Download a blank fillable Use Tax Return in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Use Tax Return with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

CLEAR FORM

PRINT FORM

01-156

(Rev.2-17/9)

USE TAX INFORMATION

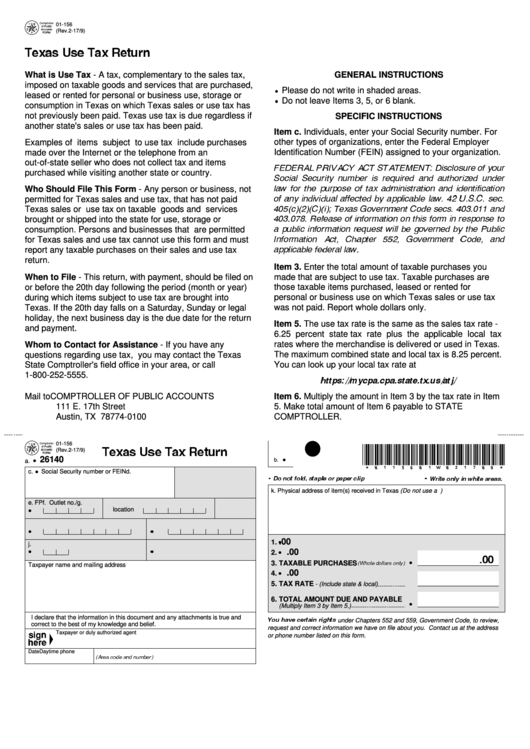

Texas Use Tax Return

What is Use Tax - A tax, complementary to the sales tax,

GENERAL INSTRUCTIONS

imposed on taxable goods and services that are purchased,

Please do not write in shaded areas.

leased or rented for personal or business use, storage or

Do not leave Items 3, 5, or 6 blank.

consumption in Texas on which Texas sales or use tax has

not previously been paid. Texas use tax is due regardless if

SPECIFIC INSTRUCTIONS

another state's sales or use tax has been paid.

Item c. Individuals, enter your Social Security number. For

Examples of items subject to use tax include purchases

other types of organizations, enter the Federal Employer

made over the Internet or the telephone from an

Identification Number (FEIN) assigned to your organization.

out-of-state seller who does not collect tax and items

FEDERAL PRIVACY ACT STATEMENT: Disclosure of your

purchased while visiting another state or country.

Social Security number is required and authorized under

law for the purpose of tax administration and identification

Who Should File This Form - Any person or business, not

of any individual affected by applicable law. 42 U.S.C. sec.

permitted for Texas sales and use tax, that has not paid

405(c)(2)(C)(i); Texas Government Code secs. 403.011 and

Texas sales or use tax on taxable goods and services

403.078. Release of information on this form in response to

brought or shipped into the state for use, storage or

a public information request will be governed by the Public

consumption. Persons and businesses that are permitted

Information Act, Chapter 552, Government Code, and

for Texas sales and use tax cannot use this form and must

applicable federal law.

report any taxable purchases on their sales and use tax

return.

Item 3. Enter the total amount of taxable purchases you

When to File - This return, with payment, should be filed on

made that are subject to use tax. Taxable purchases are

those taxable items purchased, leased or rented for

or before the 20th day following the period (month or year)

personal or business use on which Texas sales or use tax

during which items subject to use tax are brought into

Texas. If the 20th day falls on a Saturday, Sunday or legal

was not paid. Report whole dollars only.

holiday, the next business day is the due date for the return

Item 5. The use tax rate is the same as the sales tax rate -

and payment.

6.25 percent state tax rate plus the applicable local tax

Whom to Contact for Assistance - If you have any

rates where the merchandise is delivered or used in Texas.

The maximum combined state and local tax is 8.25 percent.

questions regarding use tax, you may contact the Texas

You can look up your local tax rate at

State Comptroller's field office in your area, or call

https://mycpa.cpa.state.tx.us/atj/

1-800-252-5555.

Mail to COMPTROLLER OF PUBLIC ACCOUNTS

Item 6. Multiply the amount in Item 3 by the tax rate in Item

111 E. 17th Street

5. Make total amount of Item 6 payable to STATE

Austin, TX 78774-0100

COMPTROLLER.

01-156

(Rev.2-17/9)

*0115601W021709*

Texas Use Tax Return

26140

b.

a.

I

I

c.

Social Security number or FEIN

d.

I

.

.

Do not fold, staple or paper clip

Write only in white areas.

k. Physical address of item(s) received in Texas (Do not use a P.O. box address.)

e. FP

f. Outlet no./

g.

location

I

h.

i. PM

I

I

.00

1.

j.

I

.00

2.

I

I

I

.00

(Whole dollars only)

3. TAXABLE PURCHASES

Taxpayer name and mailing address

I

.00

4.

I

5. TAX RATE

- (Include state & local)

6. TOTAL AMOUNT DUE AND PAYABLE

(Multiply Item 3 by Item 5.)

I

I declare that the information in this document and any attachments is true and

under Chapters 552 and 559, Government Code, to review,

You have certain rights

correct to the best of my knowledge and belief.

request and correct information we have on file about you. Contact us at the address

Taxpayer or duly authorized agent

or phone number listed on this form.

Date

Daytime phone

(Area code and number)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1