2009 Rut-50-X

ADVERTISEMENT

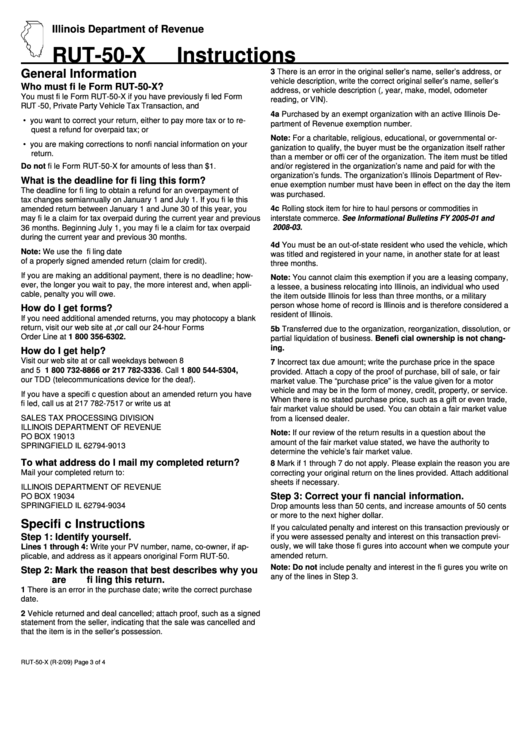

Illinois Department of Revenue

RUT-50-X Instructions

General Information

3 There is an error in the original seller’s name, seller’s address, or

vehicle description, write the correct original seller’s name, seller’s

Who must fi le Form RUT-50-X?

address, or vehicle description (i.e., year, make, model, odometer

You must fi le Form RUT-50-X if you have previously fi led Form

reading, or VIN).

RUT -50, Private Party Vehicle Tax Transaction, and

4a Purchased by an exempt organization with an active Illinois De-

• you want to correct your return, either to pay more tax or to re-

partment of Revenue exemption number.

quest a refund for overpaid tax; or

Note: For a charitable, religious, educational, or governmental or-

• you are making corrections to nonfi nancial information on your

ganization to qualify, the buyer must be the organization itself rather

return.

than a member or offi cer of the organization. The item must be titled

and/or registered in the organization’s name and paid for with the

Do not fi le Form RUT-50-X for amounts of less than $1.

organization’s funds. The organization’s Illinois Department of Rev-

What is the deadline for fi ling this form?

enue exemption number must have been in effect on the day the item

The deadline for fi ling to obtain a refund for an overpayment of

was purchased.

tax changes semiannually on January 1 and July 1. If you fi le this

4c Rolling stock item for hire to haul persons or commodities in

amended return between January 1 and June 30 of this year, you

interstate commerce. See Informational Bulletins FY 2005-01 and

may fi le a claim for tax overpaid during the current year and previous

2008-03.

36 months. Beginning July 1, you may fi le a claim for tax overpaid

during the current year and previous 30 months.

4d You must be an out-of-state resident who used the vehicle, which

Note: We use the U.S. Postal Service postmark date as the fi ling date

was titled and registered in your name, in another state for at least

of a properly signed amended return (claim for credit).

three months.

If you are making an additional payment, there is no deadline; how-

Note: You cannot claim this exemption if you are a leasing company,

ever, the longer you wait to pay, the more interest and, when appli-

a lessee, a business relocating into Illinois, an individual who used

cable, penalty you will owe.

the item outside Illinois for less than three months, or a military

person whose home of record is Illinois and is therefore considered a

How do I get forms?

resident of Illinois.

If you need additional amended returns, you may photocopy a blank

return, visit our web site at tax.illinois.gov, or call our 24-hour Forms

5b Transferred due to the organization, reorganization, dissolution, or

Order Line at 1 800 356-6302.

partial liquidation of business. Benefi cial ownership is not chang-

ing.

How do I get help?

Visit our web site at tax.illinois.gov or call weekdays between 8 a.m.

7 Incorrect tax due amount; write the purchase price in the space

and 5 p.m. at 1 800 732-8866 or 217 782-3336. Call 1 800 544-5304,

provided. Attach a copy of the proof of purchase, bill of sale, or fair

our TDD (telecommunications device for the deaf).

market

value.

The “purchase price” is the value given for a motor

vehicle and may be in the form of money, credit, property, or service.

If you have a specifi c question about an amended return you have

When there is no stated purchase price, such as a gift or even trade,

fi led, call us at 217 782-7517 or write us at

fair market value should be used. You can obtain a fair market value

SALES TAX PROCESSING DIVISION

from a licensed dealer.

ILLINOIS DEPARTMENT OF REVENUE

Note: If our review of the return results in a question about the

PO BOX 19013

amount of the fair market value stated, we have the authority to

SPRINGFIELD IL 62794-9013

determine the vehicle’s fair market value.

To what address do I mail my completed return?

8 Mark if 1 through 7 do not apply. Please explain the reason you are

Mail your completed return to:

correcting your original return on the lines provided. Attach additional

sheets if necessary.

ILLINOIS DEPARTMENT OF REVENUE

Step 3: Correct your fi nancial information.

PO BOX 19034

SPRINGFIELD IL 62794-9034

Drop amounts less than 50 cents, and increase amounts of 50 cents

or more to the next higher dollar.

Specifi c Instructions

If you calculated penalty and interest on this transaction previously or

Step 1: Identify yourself.

if you were assessed penalty and interest on this transaction previ-

ously, we will take those fi gures into account when we compute your

Lines 1 through 4: Write your PV number, name, co-owner, if ap-

amended return.

plicable, and address as it appears on original Form RUT-50.

Note: Do not include penalty and interest in the fi gures you write on

Step 2: Mark the reason that best describes why you

any of the lines in Step 3.

are fi ling this return.

1 There is an error in the purchase date; write the correct purchase

date.

2 Vehicle returned and deal cancelled; attach proof, such as a signed

statement from the seller, indicating that the sale was cancelled and

that the item is in the seller’s possession.

RUT-50-X (R-2/09)

Page 3 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4