Auto Expenses Summary

Download a blank fillable Auto Expenses Summary in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Auto Expenses Summary with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

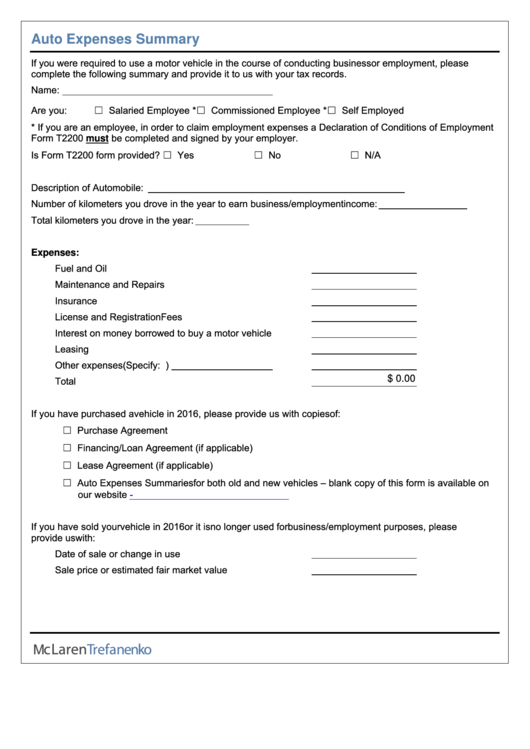

Auto Expenses Summary

If you were required to use a motor vehicle in the course of conducting business or employment, please

complete the following summary and provide it to us with your tax records.

Name:

Are you:

☐ Salaried Employee *

☐ Commissioned Employee *

☐ Self Employed

* If you are an employee, in order to claim employment expenses a Declaration of Conditions of Employment

Form T2200 must be completed and signed by your employer.

Is Form T2200 form provided?

☐ Yes

☐ No

☐ N/A

Description of Automobile:

Number of kilometers you drove in the year to earn business/employment income:

Total kilometers you drove in the year:

Expenses:

Fuel and Oil

Maintenance and Repairs

Insurance

License and Registration Fees

Interest on money borrowed to buy a motor vehicle

Leasing

Other expenses (Specify:

)

$ 0.00

Total

If you have purchased a vehicle in 2016, please provide us with copies of:

☐ Purchase Agreement

☐ Financing/Loan Agreement (if applicable)

☐ Lease Agreement (if applicable)

☐ Auto Expenses Summaries for both old and new vehicles – blank copy of this form is available on

our website

If you have sold your vehicle in 2016 or it is no longer used for business/employment purposes, please

provide us with:

Date of sale or change in use

Sale price or estimated fair market value

M

cLaren

Trefanenko

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1