Form Dol-4n - Employer'S Quarterly Tax And Wage Report - Georgia Department Of Labor

ADVERTISEMENT

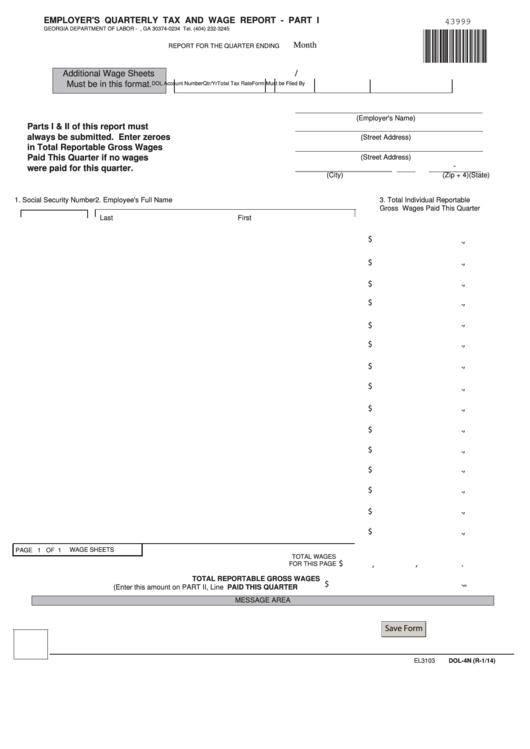

EMPLOYER'S QUARTERLY TAX AND WAGE REPORT - PART I

43999

GEORGIA DEPARTMENT OF LABOR - P.O. BOX 740234 - ATLANTA, GA 30374-0234 Tel. (404) 232-3245

Month

REPORT FOR THE QUARTER ENDING

Additional Wage Sheets

/

Must be in this format.

DOL Account Number

Qtr/Yr

Total Tax Rate

Form Must be Filed By

(Employer's Name)

Parts I & II of this report must

always be submitted. Enter zeroes

(Street Address)

in Total Reportable Gross Wages

Paid This Quarter if no wages

(Street Address)

-

were paid for this quarter.

(City)

(State)

(Zip + 4)

1. Social Security Number

2. Employee's Full Name

3. Total Individual Reportable

Gross Wages Paid This Quarter

Last

First

$

,

.

$

,

.

,

.

$

$

,

.

,

.

$

$

,

.

,

.

$

$

,

.

$

,

.

,

.

$

,

.

$

,

.

$

,

.

$

,

.

$

,

.

$

PAGE 1 OF 1

WAGE SHEETS

TOTAL WAGES

$

,

.

,

FOR THIS PAGE

TOTAL REPORTABLE GROSS WAGES

,

,

.

$

(Enter this amount on PART II, Line 2...........PAID THIS QUARTER

MESSAGE AREA

Save Form

EL3103

DOL-4N (R-1/14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2