Form Au-620 - State Of Connecticut Department Of Revenue Services Direct Payment Permit Application

ADVERTISEMENT

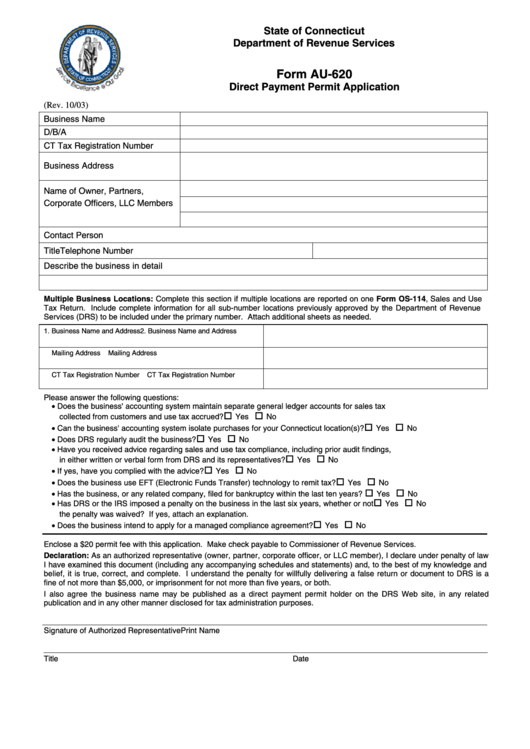

State of Connecticut

Department of Revenue Services

Form AU-620

Direct Payment Permit Application

(Rev. 10/03)

Business Name

D/B/A

CT Tax Registration Number

Business Address

Name of Owner, Partners,

Corporate Officers, LLC Members

Contact Person

Title

Telephone Number

Describe the business in detail

Multiple Business Locations: Complete this section if multiple locations are reported on one Form OS-114, Sales and Use

Tax Return. Include complete information for all sub-number locations previously approved by the Department of Revenue

Services (DRS) to be included under the primary number. Attach additional sheets as needed.

1. Business Name and Address

2. Business Name and Address

Mailing Address

Mailing Address

CT Tax Registration Number

CT Tax Registration Number

Please answer the following questions:

• Does the business' accounting system maintain separate general ledger accounts for sales tax

collected from customers and use tax accrued?

Yes

No

• Can the business' accounting system isolate purchases for your Connecticut location(s)?

Yes

No

• Does DRS regularly audit the business?

Yes

No

• Have you received advice regarding sales and use tax compliance, including prior audit findings,

in either written or verbal form from DRS and its representatives?

Yes

No

• If yes, have you complied with the advice?

Yes

No

• Does the business use EFT (Electronic Funds Transfer) technology to remit tax?

Yes

No

• Has the business, or any related company, filed for bankruptcy within the last ten years?

Yes

No

• Has DRS or the IRS imposed a penalty on the business in the last six years, whether or not

Yes

No

the penalty was waived? If yes, attach an explanation.

• Does the business intend to apply for a managed compliance agreement?

Yes

No

Enclose a $20 permit fee with this application. Make check payable to Commissioner of Revenue Services.

Declaration: As an authorized representative (owner, partner, corporate officer, or LLC member), I declare under penalty of law

I have examined this document (including any accompanying schedules and statements) and, to the best of my knowledge and

belief, it is true, correct, and complete. I understand the penalty for willfully delivering a false return or document to DRS is a

fine of not more than $5,000, or imprisonment for not more than five years, or both.

I also agree the business name may be published as a direct payment permit holder on the DRS Web site, in any related

publication and in any other manner disclosed for tax administration purposes.

Signature of Authorized Representative

Print Name

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2