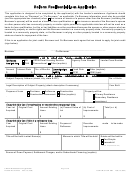

Form Hud-92900-A Va Form 26-1802a Addendum To Uniform Residential Loan Application Page 3

ADVERTISEMENT

This mortgage was rated as an “accept” or “approve” by FHA's TOTAL Mortgage Scorecard. As such, the undersigned representative of the

_____

mortgagee certifies that the mortgagee reviewed the TOTAL Mortgage Scorecard findings and that this mortgage meets the Final Underwriting

Decision (TOTAL) requirements for approval. The undersigned representative of the mortgagee also certifies that all information entered into

TOTAL Mortgage Scorecard is complete and accurately represents information obtained by the mortgagee, that the information was obtained by the

mortgagee, pursuant to FHA requirements, and that there was no defect in connection with the approval of this mortgage such that the result

reached in TOTAL should not have been relied upon and the mortgage should not have been approved in accordance with FHA requirements.

Mortgagee Representative:

Signature:__________________________________

Printed Name/Title: ____________________________________

And if applicable:

This mortgage was rated as an “accept” or “approve” by FHA's TOTAL Mortgage Scorecard and the undersigned Direct Endorsement underwriter

certifies that I have personally reviewed and underwritten the appraisal according to standard FHA requirements.

__________________________________

_________________

Direct Endorsement Underwriter Signature

DE's CHUMS ID Number

This mortgage was rated as a “refer” by a FHA's TOTAL Mortgage Scorecard, or was manually underwritten by a Direct Endorsement underwriter.

As such, the undersigned Direct Endorsement Underwriter certifies that I have personally reviewed and underwritten the appraisal report (if

applicable), credit application, and all associated documents used in underwriting this mortgage. I further certify that:

I have approved this loan and my Final Underwriting Decision was made having exercised the required level of Care and Due Diligence and in

performing my underwriting review;

I have performed all Specific Underwriter Responsibilities for Underwriters and my underwriting of the borrower’s Credit and Debt, Income,

Qualifying Ratios and Compensating Factors, if any, and the borrower’s DTI with Compensating Factors, if any, are within the parameters

established by FHA and the borrower has assets to satisfy any required down payment and closing costs of this mortgage; and

I have verified the Mortgage Insurance Premium and Mortgage Amount are accurate and this loan is in an amount that is permitted by FHA for

this loan type, property type, and geographic area.

There was no defect in connection with my approval of this mortgage such that my Final Underwriting Decision should have changed and the

mortgage should not have been approved in accordance with FHA requirements.

The Mortgagee, its owners, officers, employees or directors

(do)

(do not) have a financial interest in or a relationship, by affiliation or ownership, with the

builder or seller involved in this transaction.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4