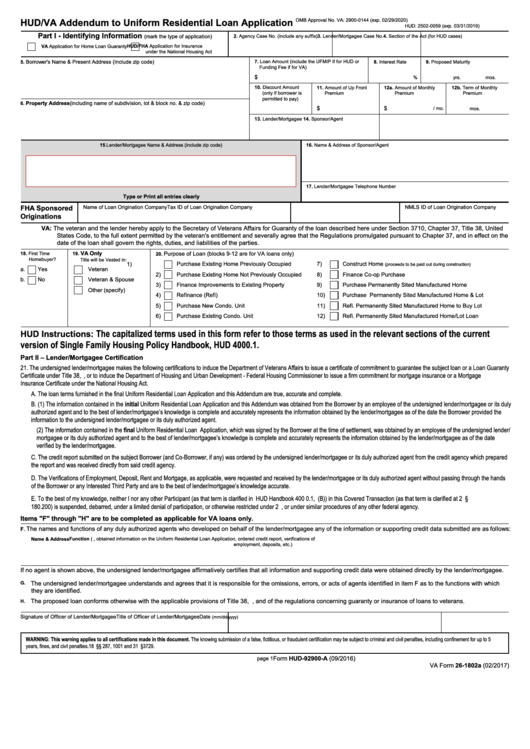

HUD/VA Addendum to Uniform Residential Loan Application

OMB Approval No. VA: 2900-0144 (exp. 02/29/2020)

HUD: 2502-0059 (exp. 03/31/2019)

Part I - Identifying Information

2. Agency Case No. (include any suffix)

3. Lender/Mortgagee Case No.

4. Section of the Act (for HUD cases)

(mark the type of application)

VA Application for Home Loan Guaranty

HUD/FHA Application for Insurance

under the National Housing Act

Borrower's Name & Present Address (Include zip code)

7. Loan Amount (include the UFMIP if for HUD or

8. Interest Rate

9. Proposed Maturity

5.

Funding Fee if for VA)

$

%

yrs.

mos.

10. Discount Amount

11. Amount of Up Front

12a. Amount of Monthly

12b. Term of Monthly

(only if borrower is

Premium

Premium

Premium

permitted to pay)

Property Address (including name of subdivision, lot & block no. & zip code)

6.

$

$

/ mo.

mos.

13. Lender/Mortgagee I.D. Code

14. Sponsor/Agent I.D. Code

15. Lender/Mortgagee Name & Address (include zip code)

16. Name & Address of Sponsor/Agent

17. Lender/Mortgagee Telephone Number

Type or Print all entries clearly

FHA Sponsored

Name of Loan Origination Company

Tax ID of Loan Origination Company

NMLS ID of Loan Origination Company

Originations

VA: The veteran and the lender hereby apply to the Secretary of Veterans Affairs for Guaranty of the loan described here under Section 3710, Chapter 37, Title 38, United

States Code, to the full extent permitted by the veteran's entitlement and severally agree that the Regulations promulgated pursuant to Chapter 37, and in effect on the

date of the loan shall govern the rights, duties, and liabilities of the parties.

VA Only

Purpose of Loan (blocks 9-12 are for VA loans only)

18. First Time

19.

20.

Homebuyer?

Title will be Vested in:

1)

Purchase Existing Home Previously Occupied

7)

Construct Home

(proceeds to be paid out during construction)

a.

Yes

Veteran

2)

Purchase Existing Home Not Previously Occupied

8)

Finance Co-op Purchase

b.

No

Veteran & Spouse

3)

Finance Improvements to Existing Property

9)

Purchase Permanently Sited Manufactured Home

Other (specify)

4)

Refinance (Refi)

10)

Purchase Permanently Sited Manufactured Home & Lot

5)

Purchase New Condo. Unit

11)

Refi. Permanently Sited Manufactured Home to Buy Lot

6)

Purchase Existing Condo. Unit

12)

Refi. Permanently Sited Manufactured Home/Lot Loan

The capitalized terms used in this form refer to those terms as used in the relevant sections of the current

HUD Instructions:

version of Single Family Housing Policy Handbook, HUD 4000.1.

Part II – Lender/Mortgagee Certification

21. The undersigned lender/mortgagee makes the following certifications to induce the Department of Veterans Affairs to issue a certificate of commitment to guarantee the subject loan or a Loan Guaranty

Certificate under Title 38, U.S. Code, or to induce the Department of Housing and Urban Development - Federal Housing Commissioner to issue a firm commitment for mortgage insurance or a Mortgage

Insurance Certificate under the National Housing Act.

A. The loan terms furnished in the final Uniform Residential Loan Application and this Addendum are true, accurate and complete.

B. (1) The information contained in the initial Uniform Residential Loan Application and this Addendum was obtained from the Borrower by an employee of the undersigned lender/mortgagee or its duly

authorized agent and to the best of lender/mortgagee’s knowledge is complete and accurately represents the information obtained by the lender/mortgagee as of the date the Borrower provided the

information to the undersigned lender/mortgagee or its duly authorized agent.

(2) The information contained in the final Uniform Residential Loan Application, which was signed by the Borrower at the time of settlement, was obtained by an employee of the undersigned lender/

mortgagee or its duly authorized agent and to the best of lender/mortgagee’s knowledge is complete and accurately represents the information obtained by the lender/mortgagee as of the date

verified by the lender/mortgagee.

C. The credit report submitted on the subject Borrower (and Co-Borrower, if any) was ordered by the undersigned lender/mortgagee or its duly authorized agent from the credit agency which prepared

the report and was received directly from said credit agency.

D. The Verifications of Employment, Deposit, Rent and Mortgage, as applicable, were requested and received by the lender/mortgagee or its duly authorized agent without passing through the hands

of the Borrower or any Interested Third Party and are to the best of lender/mortgagee’s knowledge accurate.

E. To the best of my knowledge, neither I nor any other Participant (as that term is clarified in HUD Handbook 400 0.1, II.A.1.b.ii.(B)) in this Covered Transaction (as that term is clarified at 2 C.F.R. §

180.200) is suspended, debarred, under a limited denial of participation, or otherwise restricted under 2 C.F.R. part 2424 or 24 C.F.R. p art 25, or under similar procedures of any other federal agency.

Items "F" through "H" are to be completed as applicable for VA loans only.

The names and functions of any duly authorized agents who developed on behalf of the lender/mortgagee any of the information or supporting credit data submitted are as follows:

F

.

Name & Address

Function (e.g., obtained information on the Uniform Residential Loan Application, ordered credit report, verifications of

employment, deposits, etc.)

If no agent is shown above, the undersigned lender/mortgagee affirmatively certifies that all information and supporting credit data were obtained directly by the lender/mortgagee.

G.

The undersigned lender/mortgagee understands and agrees that it is responsible for the omissions, errors, or acts of agents identified in item F as to the functions with which

they are identified.

The proposed loan conforms otherwise with the applicable provisions of Title 38, U.S. Code, and of the regulations concerning guaranty or insurance of loans to veterans.

H.

Signature of Officer of Lender/Mortgagee

Title of Officer of Lender/Mortgagee

Date

(mm/dd/yyyy)

WARNING: This warning applies to all certifications made in this document. The knowing submission of a false, fictitious, or fraudulent certification may be subject to criminal and civil penalties, including confinement for up to 5

years, fines, and civil penalties. 18 U.S.C. §§ 287, 1001 and 31 U.S.C. §3729.

Form HUD-92900-A (09/2016)

page 1

VA Form 26-1802a (02/2017)

1

1 2

2 3

3 4

4