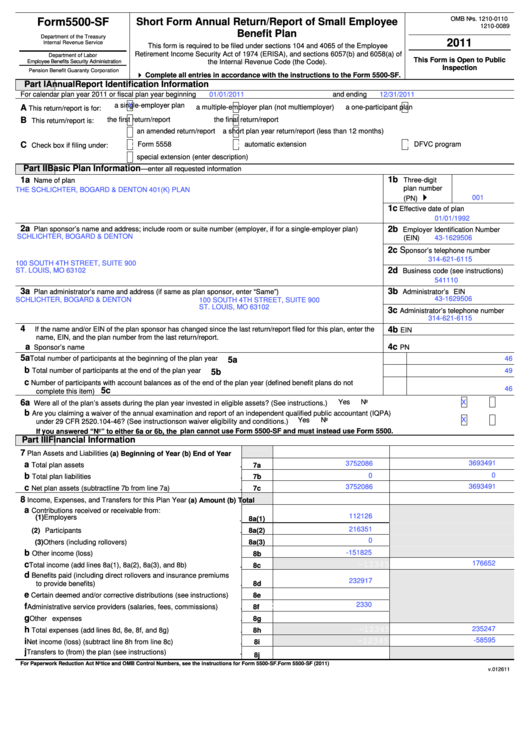

Form 5500-Sf - Short Form Annual Return/report Of Small Employee Benefit Plan - 2011

ADVERTISEMENT

OMB Nos. 1210-0110

Form 5500-SF

Short Form Annual Return/Report of Small Employee

1210-0089

Benefit Plan

Department of the Treasury

2011

Internal Revenue Service

This form is required to be filed under sections 104 and 4065 of the Employee

Retirement Income Security Act of 1974 (ERISA), and sections 6057(b) and 6058(a) of

Department of Labor

This Form is Open to Public

the Internal Revenue Code (the Code).

Employee Benefits Security Administration

Inspection

Pension Benefit Guaranty Corporation

Complete all entries in accordance with the instructions to the Form 5500-SF.

Part I

Annual Report Identification Information

For calendar plan year 2011 or fiscal plan year beginning

01/01/2011

and ending

12/31/2011

X

X

a single-employer plan

A

X

X

a multiple-employer plan (not multiemployer)

a one-participant plan

This return/report is for:

B

X

X

the first return/report

the final return/report

This return/report is:

X

X

an amended return/report

a short plan year return/report (less than 12 months)

X

X

X

C

Form 5558

automatic extension

DFVC program

Check box if filing under:

X

b

special extension (enter description)

Part II

Basic Plan Information

—enter all requested information

1b

1a

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

Name of plan

Three-digit

plan number

THE SCHLICHTER, BOGARD & DENTON 401(K) PLAN

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

001

001

(PN)

ABCDEFGHI ABCDEFGHI ABCDEFGHI

1c

Effective date of plan

YYYY-MM-DD

01/01/1992

2a

2b

Plan sponsor’s name and address; include room or suite number (employer, if for a single-employer plan)

Employer Identification Number

SCHLICHTER, BOGARD & DENTON

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

43-1629506

012345678

(EIN)

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

2c S

ponsor’s telephone number

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

314-621-6115

1234567890

100 SOUTH 4TH STREET, SUITE 900

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

2d

ST. LOUIS, MO 63102

Business code (see instructions)

ABCDEFGHI ABCDEFGH ABCDEFGHI ABCDEFGHI ABCDEFGHI I

123456

541110

3a

3b

Plan administrator’s name and address (if same as plan sponsor, enter “Same”)

Administrator’s EIN

43-1629506

SCHLICHTER, BOGARD & DENTON

100 SOUTH 4TH STREET, SUITE 900

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

012345678

ST. LOUIS, MO 63102

3c

ABCDEFGHI

Administrator’s telephone number

314-621-6115

1234567890

123456789 ABCDEFGHI ABCDEFGHI ABCDE123456789 ABCDEFGHI ABCDEFGHI A

4

If the name and/or EIN of the plan sponsor has changed since the last return/report filed for this plan, enter the

4b

012345678

EIN

name, EIN, and the plan number from the last return/report.

a

4c

Sponsor’s name

DEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI CDEFGHI

PN

012

5a

Total number of participants at the beginning of the plan year ..................................................................................

46

5a

12345678

b

Total number of participants at the end of the plan year ............................................................................................

49

5b

12345678

c

Number of participants with account balances as of the end of the plan year (defined benefit plans do not

46

5c

12345678

complete this item) .....................................................................................................................................................

X

X

6a

X

Yes

No

Were all of the plan’s assets during the plan year invested in eligible assets? (See instructions.) ..........................................................

b

Are you claiming a waiver of the annual examination and report of an independent qualified public accountant (IQPA)

X

X

X

Yes

No

under 29 CFR 2520.104-46? (See instructions on waiver eligibility and conditions.) ................................................................................

If you answered “No” to either 6a or 6b, the plan cannot use Form 5500-SF and must instead use Form 5500.

Part III

Financial Information

7

Plan Assets and Liabilities

(a) Beginning of Year

(b) End of Year

3752086

3693491

a

-123456789012345

-123456789012345

Total plan assets ................................................................................

7a

b

0

-123456789012345

0

123456789012345

Total plan liabilities .............................................................................

7b

3693491

c

3752086

-123456789012345

-123456789012345

Net plan assets (subtract line 7b from line 7a) ...................................

7c

8

Income, Expenses, and Transfers for this Plan Year

(a) Amount

(b) Total

a

Contributions received or receivable from:

112126

-123456789012345

(1) Employers ................................................................................... 8a(1)

-123456789012345

216351

(2) Participants ................................................................................. 8a(2)

0

-123456789012345

(3) Others (including rollovers) .......................................................... 8a(3)

b

-123456789012345

-151825

Other income (loss) ............................................................................

8b

176652

c

-123456789012345

Total income (add lines 8a(1), 8a(2), 8a(3), and 8b) .........................

8c

d

Benefits paid (including direct rollovers and insurance premiums

232917

-123456789012345

to provide benefits) .............................................................................

8d

e

-123456789012345

Certain deemed and/or corrective distributions (see instructions) .....

8e

2330

f

-123456789012345

Administrative service providers (salaries, fees, commissions) .........

8f

g

-123456789012345

Other expenses ..................................................................................

8g

h

-123456789012345

235247

Total expenses (add lines 8d, 8e, 8f, and 8g) ....................................

8h

-58595

i

-123456789012345

Net income (loss) (subtract line 8h from line 8c) ................................

8i

j

Transfers to (from) the plan (see instructions) ...................................

-123456789012345

8j

For Paperwork Reduction Act Notice and OMB Control Numbers, see the instructions for Form 5500-SF.

Form 5500-SF (2011)

v.012611

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2