North Carolina Department Of Revenue (Form Nc 8633) Application To Participate In The Electronic Filing Program

ADVERTISEMENT

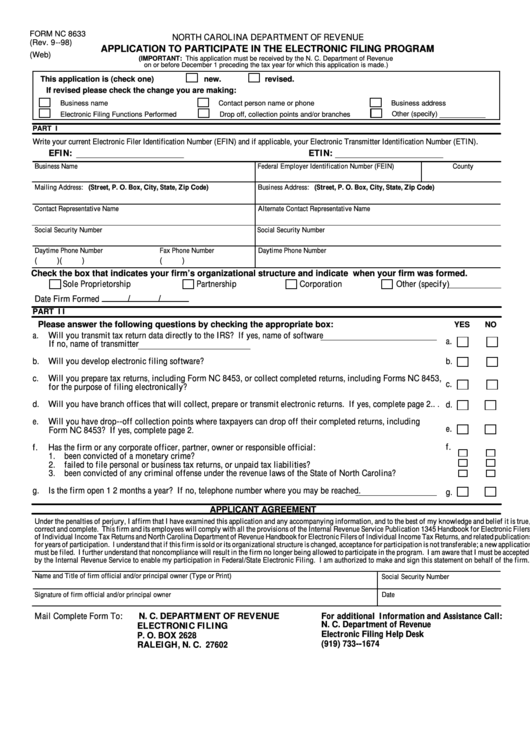

FORM NC 8633

NORTH CAROLINA DEPARTMENT OF REVENUE

(Rev. 9--98)

APPLICATION TO PARTICIPATE IN THE ELECTRONIC FILING PROGRAM

(Web)

(IMPORTANT: This application must be received by the N. C. Department of Revenue

on or before December 1 preceding the tax year for which this application is made.)

This application is (check one)

new.

revised.

If revised please check the change you are making:

Business name

Contact person name or phone

Business address

Other (specify)

Electronic Filing Functions Performed

Drop off, collection points and/or branches

PART I

.

Write your current Electronic Filer Identification Number (EFIN) and if applicable, your Electronic Transmitter Identification Number (ETIN)

EFIN:

ETIN:

Business Name

Federal Employer Identification Number (FEIN)

County

Mailing Address: (Street, P. O. Box, City, State, Zip Code)

Business Address: (Street, P. O. Box, City, State, Zip Code)

Contact Representative Name

Alternate Contact Representative Name

Social Security Number

Social Security Number

Daytime Phone Number

Fax Phone Number

Daytime Phone Number

(

)

(

)

(

)

Check the box that indicates your firm’s organizational structure and indicate when your firm was formed.

Sole Proprietorship

Partnership

Corporation

Other (specify)

/

/

Date Firm Formed

PART I I

Please answer the following questions by checking the appropriate box:

YES

NO

a.

Will you transmit tax return data directly to the IRS? If yes, name of software

a.

If no, name of transmitter

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b.

Will you develop electronic filing software? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b.

c.

Will you prepare tax returns, including Form NC 8453, or collect completed returns, including Forms NC 8453,

c.

for the purpose of filing electronically? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d.

Will you have branch offices that will collect, prepare or transmit electronic returns. If yes, complete page 2. . .

d.

e.

Will you have drop- -off collection points where taxpayers can drop off their completed returns, including

e.

Form NC 8453? If yes, complete page 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

f.

f.

Has the firm or any corporate officer, partner, owner or responsible official:

1.

been convicted of a monetary crime? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

failed to file personal or business tax returns, or unpaid tax liabilities? . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

been convicted of any criminal offense under the revenue laws of the State of North Carolina? . . . . . . . . . .

g.

Is the firm open 12 months a year? If no, telephone number where you may be reached.

g.

APPLICANT AGREEMENT

Under the penalties of perjury, I affirm that I have examined this application and any accompanying information, and to the best of my knowledge and belief it is true,

correct and complete. This firm and its employees will comply with all the provisions of the Internal Revenue Service Publication 1345 Handbook for Electronic Filers

of Individual Income Tax Returns and North Carolina Department of Revenue Handbook for Electronic Filers of Individual Income Tax Returns, and related publications

for years of participation. I understand that if this firm is sold or its organizational structure is changed, acceptance for participation is not transferable; a new application

must be filed. I further understand that noncompliance will result in the firm no longer being allowed to participate in the program. I am aware that I must be accepted

by the Internal Revenue Service to enable my participation in Federal/State Electronic Filing. I am authorized to make and sign this statement on behalf of the firm.

Name and Title of firm official and/or principal owner (Type or Print)

Social Security Number

Signature of firm official and/or principal owner

Date

N. C. DEPARTMENT OF REVENUE

For additional Information and Assistance Call:

Mail Complete Form To:

N. C. Department of Revenue

ELECTRONIC FILING

Electronic Filing Help Desk

P. O. BOX 2628

(919) 733- -1674

RALEIGH, N. C. 27602

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2