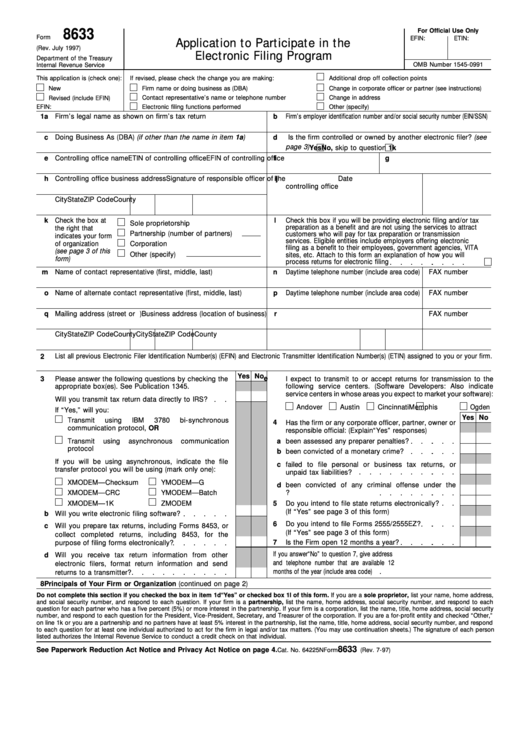

Form 8633 (Rev. July 1997) - Application To Participate In The Electronic Filing Program

ADVERTISEMENT

8633

For Official Use Only

Form

EFIN:

ETIN:

Application to Participate in the

(Rev. July 1997)

Electronic Filing Program

Department of the Treasury

OMB Number 1545-0991

Internal Revenue Service

This application is (check one):

If revised, please check the change you are making:

Additional drop off collection points

New

Firm name or doing business as (DBA)

Change in corporate officer or partner (see instructions)

Contact representative’s name or telephone number

Change in address

Revised (include EFIN)

EFIN:

Electronic filing functions performed

Other (specify)

1a

Firm’s legal name as shown on firm’s tax return

b

Firm’s employer identification number and/or social security number (EIN/SSN)

c

Doing Business As (DBA) (if other than the name in item 1a)

d

Is the firm controlled or owned by another electronic filer? (see

page 3)

Yes

No, skip to question 1k

e

Controlling office name

f

ETIN of controlling office

g

EFIN of controlling office

h

Controlling office business address

i

Signature of responsible officer of the

j

Date

controlling office

City

State

ZIP Code

County

k

Check the box at

l

Check this box if you will be providing electronic filing and/or tax

Sole proprietorship

preparation as a benefit and are not using the services to attract

the right that

Partnership (number of partners)

customers who will pay for tax preparation or transmission

indicates your form

services. Eligible entities include employers offering electronic

of organization

Corporation

filing as a benefit to their employees, government agencies, VITA

(see page 3 of this

Other (specify)

sites, etc. Attach to this form an explanation of how you will

form)

process returns for electronic filing

m

Name of contact representative (first, middle, last)

n

Daytime telephone number (include area code)

FAX number

o

Name of alternate contact representative (first, middle, last)

p

Daytime telephone number (include area code)

FAX number

q

Mailing address (street or P.O. box)

r

Business address (location of business)

FAX number

City

State

ZIP Code

County

City

State

ZIP Code

County

2

List all previous Electronic Filer Identification Number(s) (EFIN) and Electronic Transmitter Identification Number(s) (ETIN) assigned to you or your firm.

Yes No

e

3

Please answer the following questions by checking the

I expect to transmit to or accept returns for transmission to the

appropriate box(es). See Publication 1345.

following service centers. (Software Developers: Also indicate

service centers in whose areas you expect to market your software):

Will you transmit tax return data directly to IRS?

Andover

Austin

Cincinnati

Memphis

Ogden

If “Yes,” will you:

Yes No

Transmit

using

IBM

3780

bi-synchronous

4

Has the firm or any corporate officer, partner, owner or

communication protocol, OR

responsible official: (Explain “Yes” responses)

Transmit

using

asynchronous

communication

a

been assessed any preparer penalties?

protocol

b

been convicted of a monetary crime?

If you will be using asynchronous, indicate the file

c

failed to file personal or business tax returns, or

transfer protocol you will be using (mark only one):

unpaid tax liabilities?

XMODEM—Checksum

YMODEM—G

d

been convicted of any criminal offense under the

YMODEM—Batch

XMODEM—CRC

U.S. Internal Revenue laws?

XMODEM—1K

ZMODEM

5

Do you intend to file state returns electronically?

(If “Yes” see page 3 of this form)

b

Will you write electronic filing software?

6

Do you intend to file Forms 2555/2555EZ?

c

Will you prepare tax returns, including Forms 8453, or

(If “Yes” see page 3 of this form)

collect completed returns, including 8453, for the

7

Is the Firm open 12 months a year?

purpose of filing forms electronically?

If you answer “No” to question 7, give address

d

Will you receive tax return information from other

and telephone number that are available 12

electronic filers, format return information and send

months of the year (include area code)

returns to a transmitter?

8

Principals of Your Firm or Organization (continued on page 2)

Do not complete this section if you checked the box in item 1d “Yes” or checked box 1l of this form. If you are a sole proprietor, list your name, home address,

and social security number, and respond to each question. If your firm is a partnership, list the name, home address, social security number, and respond to each

question for each partner who has a five percent (5%) or more interest in the partnership. If your firm is a corporation, list the name, title, home address, social security

number, and respond to each question for the President, Vice-President, Secretary, and Treasurer of the corporation. If you are a for-profit entity and checked “Other,”

on line 1k or you are a partnership and no partners have at least 5% interest in the partnership, list the name, title, home address, social security number, and respond

to each question for at least one individual authorized to act for the firm in legal and/or tax matters. (You may use continuation sheets.) The signature of each person

listed authorizes the Internal Revenue Service to conduct a credit check on that individual.

8633

See Paperwork Reduction Act Notice and Privacy Act Notice on page 4.

Cat. No. 64225N

Form

(Rev. 7-97)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4