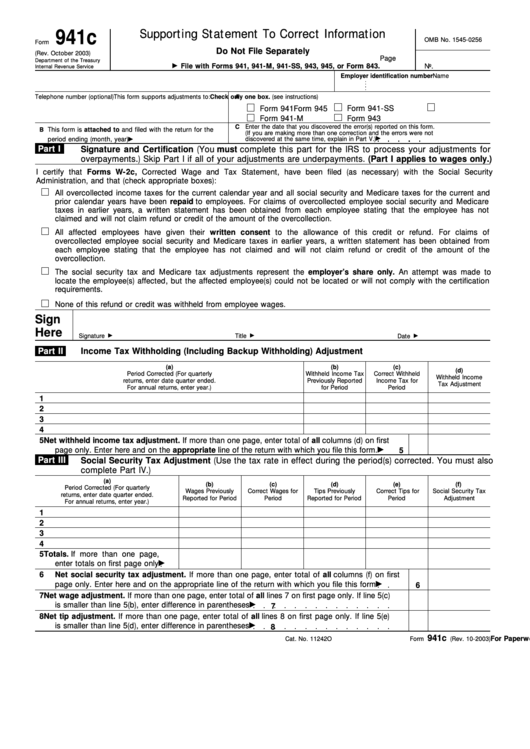

941c

Supporting Statement To Correct Information

OMB No. 1545-0256

Form

Do Not File Separately

(Rev. October 2003)

Page

Department of the Treasury

File with Forms 941, 941-M, 941-SS, 943, 945, or Form 843.

No.

Internal Revenue Service

Name

Employer identification number

Telephone number (optional)

A

This form supports adjustments to:

Check only one box. (see instructions)

Form 941

Form 941-SS

Form 945

Form 941-M

Form 943

C

Enter the date that you discovered the error(s) reported on this form.

B

This form is attached to and filed with the return for the

(If you are making more than one correction and the errors were not

period ending (month, year)

discovered at the same time, explain in Part V.)

Part I

Signature and Certification (You must complete this part for the IRS to process your adjustments for

overpayments.) Skip Part I if all of your adjustments are underpayments. (Part I applies to wages only.)

I certify that Forms W-2c, Corrected Wage and Tax Statement, have been filed (as necessary) with the Social Security

Administration, and that (check appropriate boxes):

All overcollected income taxes for the current calendar year and all social security and Medicare taxes for the current and

prior calendar years have been repaid to employees. For claims of overcollected employee social security and Medicare

taxes in earlier years, a written statement has been obtained from each employee stating that the employee has not

claimed and will not claim refund or credit of the amount of the overcollection.

All affected employees have given their written consent to the allowance of this credit or refund. For claims of

overcollected employee social security and Medicare taxes in earlier years, a written statement has been obtained from

each employee stating that the employee has not claimed and will not claim refund or credit of the amount of the

overcollection.

The social security tax and Medicare tax adjustments represent the employer’s share only. An attempt was made to

locate the employee(s) affected, but the affected employee(s) could not be located or will not comply with the certification

requirements.

None of this refund or credit was withheld from employee wages.

Sign

Here

Signature

Title

Date

Part II

Income Tax Withholding (Including Backup Withholding) Adjustment

(a)

(b)

(c)

(d)

Period Corrected (For quarterly

Withheld Income Tax

Correct Withheld

Withheld Income

returns, enter date quarter ended.

Previously Reported

Income Tax for

Tax Adjustment

For annual returns, enter year.)

for Period

Period

1

2

3

4

5

Net withheld income tax adjustment. If more than one page, enter total of all columns (d) on first

page only. Enter here and on the appropriate line of the return with which you file this form.

5

Part III

Social Security Tax Adjustment (Use the tax rate in effect during the period(s) corrected. You must also

complete Part IV.)

(a)

(b)

(c)

(d)

(e)

(f)

Period Corrected (For quarterly

Wages Previously

Correct Wages for

Tips Previously

Correct Tips for

Social Security Tax

returns, enter date quarter ended.

Reported for Period

Period

Reported for Period

Period

Adjustment

For annual returns, enter year.)

1

2

3

4

5

Totals. If more than one page,

enter totals on first page only

6

Net social security tax adjustment. If more than one page, enter total of all columns (f) on first

page only. Enter here and on the appropriate line of the return with which you file this form

6

7

Net wage adjustment. If more than one page, enter total of all lines 7 on first page only. If line 5(c)

is smaller than line 5(b), enter difference in parentheses

7

8

Net tip adjustment. If more than one page, enter total of all lines 8 on first page only. If line 5(e)

is smaller than line 5(d), enter difference in parentheses

8

941c

For Paperwork Reduction Act Notice, see page 4.

Cat. No. 11242O

Form

(Rev. 10-2003)

1

1 2

2