Form OR-20-V

Page 1 of 1, 150-102-172 (Rev. 10-16)

Oregon Department of Revenue

Oregon Corporation Tax Payment Voucher and Instructions

Use this voucher to send the following payments:

• Tax due for an original return.

• Tax due by the original return’s due date if you are filing for an extension on your return.

• Estimated tax payments.

• Tax due for an amended return filed for any year.

Don’t use this voucher if:

• Payment is being sent electronically.

• Payment is for pass-through entity nonresident owner payments; instead use Form OR-19-V.

Required for accurate processing:

• Calendar and fiscal year filers, fill in the beginning and ending dates of your tax year.

• Enter your FEIN (federal employer identification number).

Make your check payable to: Oregon Department of Revenue. To ensure proper credit to your account, write the filer’s

name, FEIN, and tax year beginning and ending dates on your check.

Mailing information:

Estimated and extension payments: Oregon Department of Revenue

PO Box 14780

Salem OR 97309-0469

All other payments:

Oregon Department of Revenue

PO Box 14790

Salem OR 97309-0470

Note: This voucher isn’t an extension to file. Oregon accepts the federal extension. If you need an Oregon-only extension,

fill out the federal extension form and write “For Oregon only” at the top. Don’t send a copy now. Include the federal

extension form when you file your Oregon return and check the “Extension” box on the Oregon return.

Visit to print more vouchers.

✂

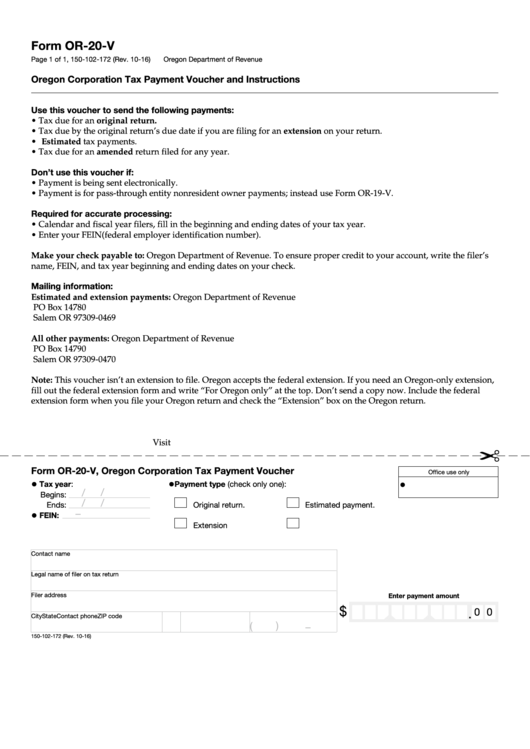

Form OR-20-V, Oregon Corporation Tax Payment Voucher

Office use only

•

•

•

Tax year:

Payment type (check only one):

Clear form

/

/

Begins:

/

/

Ends:

Original return.

Estimated payment.

–

•

FEIN:

Extension payment.

Amended return.

Contact name

Legal name of filer on tax return

Filer address

Enter payment amount

$

0 0

.

City

State

ZIP code

Contact phone

)

(

–

150-102-172 (Rev. 10-16)

1

1