Tiaa Cref Salary Reduction Form - Clarke University

ADVERTISEMENT

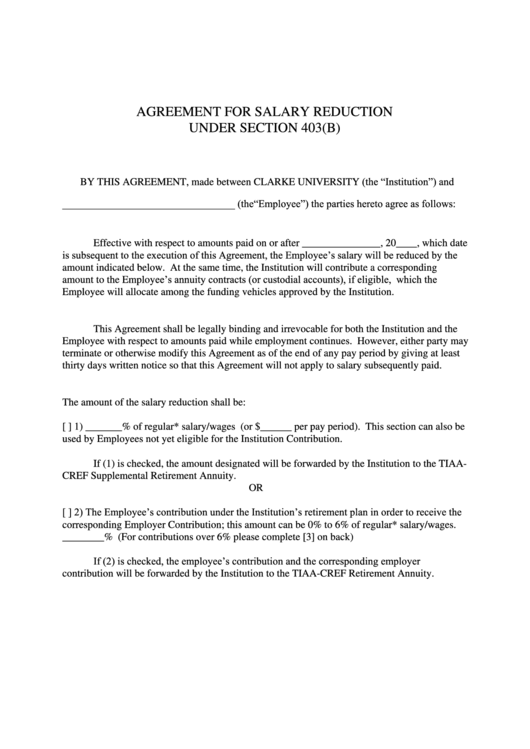

AGREEMENT FOR SALARY REDUCTION

UNDER SECTION 403(B)

BY THIS AGREEMENT, made between CLARKE UNIVERSITY (the “Institution”) and

_________________________________ (the“Employee”) the parties hereto agree as follows:

Effective with respect to amounts paid on or after _______________, 20____, which date

is subsequent to the execution of this Agreement, the Employee’s salary will be reduced by the

amount indicated below. At the same time, the Institution will contribute a corresponding

amount to the Employee’s annuity contracts (or custodial accounts), if eligible, which the

Employee will allocate among the funding vehicles approved by the Institution.

This Agreement shall be legally binding and irrevocable for both the Institution and the

Employee with respect to amounts paid while employment continues. However, either party may

terminate or otherwise modify this Agreement as of the end of any pay period by giving at least

thirty days written notice so that this Agreement will not apply to salary subsequently paid.

The amount of the salary reduction shall be:

[ ] 1) _______% of regular* salary/wages (or $______ per pay period). This section can also be

used by Employees not yet eligible for the Institution Contribution.

If (1) is checked, the amount designated will be forwarded by the Institution to the TIAA-

CREF Supplemental Retirement Annuity.

OR

[ ] 2) The Employee’s contribution under the Institution’s retirement plan in order to receive the

corresponding Employer Contribution; this amount can be 0% to 6% of regular* salary/wages.

________% (For contributions over 6% please complete [3] on back)

If (2) is checked, the employee’s contribution and the corresponding employer

contribution will be forwarded by the Institution to the TIAA-CREF Retirement Annuity.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2