Form Fl-705 - State Of Oklahoma

Download a blank fillable Form Fl-705 - State Of Oklahoma in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Fl-705 - State Of Oklahoma with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

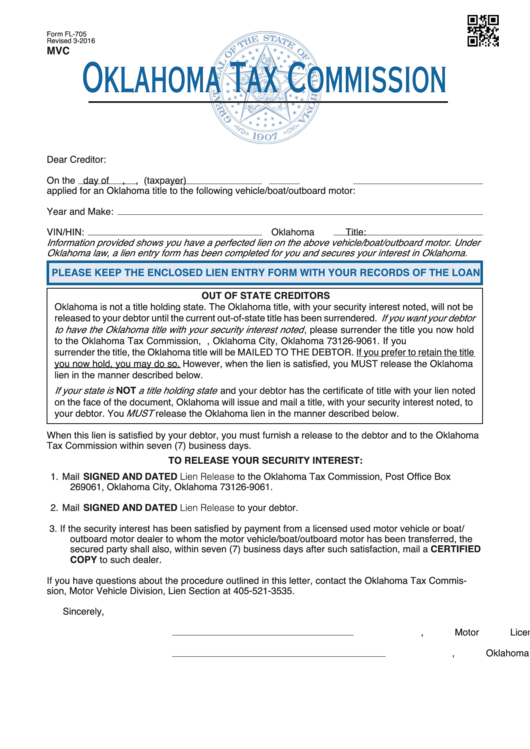

Form FL-705

Revised 3-2016

MVC

Oklahoma Tax Commission

Dear Creditor:

On the

day of

,

, (taxpayer)

applied for an Oklahoma title to the following vehicle/boat/outboard motor:

Year and Make:

VIN/HIN:

Oklahoma Title:

Information provided shows you have a perfected lien on the above vehicle/boat/outboard motor. Under

Oklahoma law, a lien entry form has been completed for you and secures your interest in Oklahoma.

PLEASE KEEP THE ENCLOSED LIEN ENTRY FORM WITH YOUR RECORDS OF THE LOAN

OUT OF STATE CREDITORS

Oklahoma is not a title holding state. The Oklahoma title, with your security interest noted, will not be

If you want your debtor

released to your debtor until the current out-of-state title has been surrendered.

to have the Oklahoma title with your security interest noted

, please surrender the title you now hold

to the Oklahoma Tax Commission, P.O. Box 269061, Oklahoma City, Oklahoma 73126-9061. If you

surrender the title, the Oklahoma title will be MAILED TO THE DEBTOR. If you prefer to retain the title

you now hold, you may do so. However, when the lien is satisfied, you MUST release the Oklahoma

lien in the manner described below.

If your state is

a title holding state

NOT

and your debtor has the certificate of title with your lien noted

on the face of the document, Oklahoma will issue and mail a title, with your security interest noted, to

MUST

your debtor. You

release the Oklahoma lien in the manner described below.

When this lien is satisfied by your debtor, you must furnish a release to the debtor and to the Oklahoma

Tax Commission within seven (7) business days.

TO RELEASE YOUR SECURITY INTEREST:

Mail SIGNED AND DATED Lien Release to the Oklahoma Tax Commission, Post Office Box

1.

269061, Oklahoma City, Oklahoma 73126-9061.

Mail SIGNED AND DATED Lien Release to your debtor.

2.

3.

If the security interest has been satisfied by payment from a licensed used motor vehicle or boat/

outboard motor dealer to whom the motor vehicle/boat/outboard motor has been transferred, the

secured party shall also, within seven (7) business days after such satisfaction, mail a CERTIFIED

COPY to such dealer.

If you have questions about the procedure outlined in this letter, contact the Oklahoma Tax Commis-

sion, Motor Vehicle Division, Lien Section at 405-521-3535.

Sincerely,

, Motor License Agent

, Oklahoma

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1