Form Doa-6448 (Substitute W-9) - Taxpayer Identification Number (Tin) Verification - State Of Wisconsin Department Of Administration

ADVERTISEMENT

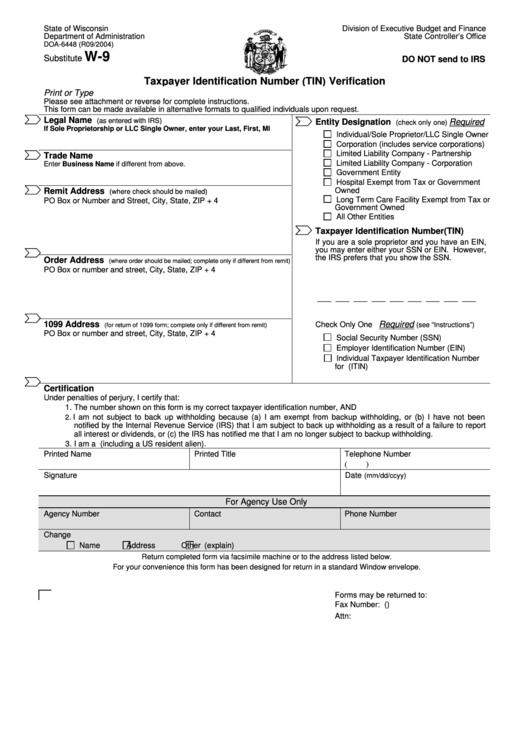

State of Wisconsin

Division of Executive Budget and Finance

Department of Administration

State Controller’s Office

DOA-6448 (R09/2004)

W-9

Substitute

DO NOT send to IRS

Taxpayer Identification Number (TIN) Verification

Print or Type

Please see attachment or reverse for complete instructions.

This form can be made available in alternative formats to qualified individuals upon request.

Legal Name

(as entered with IRS)

Entity Designation

Required

(check only one)

If Sole Proprietorship or LLC Single Owner, enter your Last, First, MI

Individual/Sole Proprietor/LLC Single Owner

Corporation (includes service corporations)

Limited Liability Company - Partnership

Trade Name

Limited Liability Company - Corporation

Enter Business Name if different from above.

Government Entity

Hospital Exempt from Tax or Government

Owned

Remit Address

(where check should be mailed)

Long Term Care Facility Exempt from Tax or

PO Box or Number and Street, City, State, ZIP + 4

Government Owned

All Other Entities

Taxpayer Identification Number (TIN)

If you are a sole proprietor and you have an EIN,

you may enter either your SSN or EIN. However,

the IRS prefers that you show the SSN.

Order Address

(where order should be mailed; complete only if different from remit)

PO Box or number and street, City, State, ZIP + 4

___ ___ ___ ___ ___ ___ ___ ___ ___

1099 Address

Required

Check Only One

(see “Instructions”)

(for return of 1099 form; complete only if different from remit)

PO Box or number and street, City, State, ZIP + 4

Social Security Number (SSN)

Employer Identification Number (EIN)

Individual Taxpayer Identification Number

for U.S. Resident Aliens (ITIN)

Certification

Under penalties of perjury, I certify that:

1. The number shown on this form is my correct taxpayer identification number, AND

I am not subject to back up withholding because (a) I am exempt from backup withholding, or (b) I have not been

2.

notified by the Internal Revenue Service (IRS) that I am subject to back up withholding as a result of a failure to report

all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding.

3. I am a U.S. person (including a US resident alien).

Printed Name

Printed Title

Telephone Number

(

)

Signature

Date

(mm/dd/ccyy)

For Agency Use Only

Agency Number

Contact

Phone Number

Change

Name

Address

Other (explain)

Return completed form via facsimile machine or to the address listed below.

For your convenience this form has been designed for return in a standard Window envelope.

Forms may be returned to:

Fax Number: (

)

Attn:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3