Instructions For Form Rp-458-B Application For Cold War Veterans Exemption From Real Property Taxation

ADVERTISEMENT

RP- 458-b-I

Department of Taxation and Finance

Office of Real Property Tax Services

Instructions for Form RP-458-b

(1/16)

Application for Cold War Veterans

Exemption from Real Property Taxation

General information

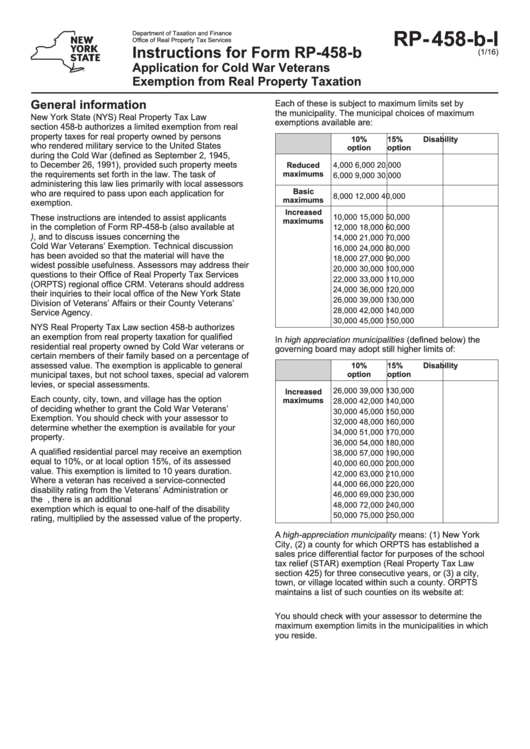

Each of these is subject to maximum limits set by

the municipality. The municipal choices of maximum

New York State (NYS) Real Property Tax Law

exemptions available are:

section 458-b authorizes a limited exemption from real

property taxes for real property owned by persons

10%

15%

Disability

who rendered military service to the United States

option

option

during the Cold War (defined as September 2, 1945,

to December 26, 1991), provided such property meets

4,000

6,000

20,000

Reduced

the requirements set forth in the law. The task of

maximums

6,000

9,000

30,000

administering this law lies primarily with local assessors

Basic

who are required to pass upon each application for

8,000

12,000

40,000

maximums

exemption.

Increased

These instructions are intended to assist applicants

10,000

15,000

50,000

maximums

in the completion of Form RP-458-b (also available at

12,000

18,000

60,000

), and to discuss issues concerning the

14,000

21,000

70,000

Cold War Veterans’ Exemption. Technical discussion

16,000

24,000

80,000

has been avoided so that the material will have the

18,000

27,000

90,000

widest possible usefulness. Assessors may address their

20,000

30,000

100,000

questions to their Office of Real Property Tax Services

22,000

33,000

110,000

(ORPTS) regional office CRM. Veterans should address

24,000

36,000

120,000

their inquiries to their local office of the New York State

26,000

39,000

130,000

Division of Veterans’ Affairs or their County Veterans’

28,000

42,000

140,000

Service Agency.

30,000

45,000

150,000

NYS Real Property Tax Law section 458-b authorizes

an exemption from real property taxation for qualified

In high appreciation municipalities (defined below) the

residential real property owned by Cold War veterans or

governing board may adopt still higher limits of:

certain members of their family based on a percentage of

assessed value. The exemption is applicable to general

10%

15%

Disability

municipal taxes, but not school taxes, special ad valorem

option

option

levies, or special assessments.

26,000

39,000

130,000

Increased

Each county, city, town, and village has the option

maximums

28,000

42,000

140,000

of deciding whether to grant the Cold War Veterans’

30,000

45,000

150,000

Exemption. You should check with your assessor to

32,000

48,000

160,000

determine whether the exemption is available for your

34,000

51,000

170,000

property.

36,000

54,000

180,000

A qualified residential parcel may receive an exemption

38,000

57,000

190,000

equal to 10%, or at local option 15%, of its assessed

40,000

60,000

200,000

value. This exemption is limited to 10 years duration.

42,000

63,000

210,000

Where a veteran has received a service-connected

44,000

66,000

220,000

disability rating from the Veterans’ Administration or

46,000

69,000

230,000

the U.S. Department of Defense, there is an additional

48,000

72,000

240,000

exemption which is equal to one-half of the disability

50,000

75,000

250,000

rating, multiplied by the assessed value of the property.

A high-appreciation municipality means: (1) New York

City, (2) a county for which ORPTS has established a

sales price differential factor for purposes of the school

tax relief (STAR) exemption (Real Property Tax Law

section 425) for three consecutive years, or (3) a city,

town, or village located within such a county. ORPTS

maintains a list of such counties on its website at:

/pit/property/star/diff.htm

You should check with your assessor to determine the

maximum exemption limits in the municipalities in which

you reside.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2