INSTRUCTIONS FOR USE OF RESALE CERTIFICATES

FOR NON-NEW JERSEY SELLERS ST-3NR

Good Faith - To act in good faith means to act in accordance with standards of honesty. In general, registered sellers

1.

who accept exemption certificates in good faith are relieved of liability for the collection and payment of sales tax on

the transactions covered by the exemption certificate.

In order for good faith to be established, the following conditions must be met:

(a) Certificate must contain no statement or entry which the seller knows is false or misleading;

(b) Certificate must be an official form or a proper and substantive reproduction, including electronic;

(c) Certificate must be filled out completely;

(d) Certificate must be dated and include the purchaser’s New Jersey tax identification number or, for a purchaser

that is not registered in New Jersey, the Federal employer identification number or out-of-State registration

number. Individual purchasers must include their driver’s license number; and

(e) Certificate or required data must be provided within 90 days of the sale.

The seller may, therefore, accept this certificate in good faith as a basis for exempting sales to the signatory

purchaser and is relieved of liability even if it is determined that the purchaser improperly claimed the exemption.

2.

Improper Certificate - Sales transactions which are not supported by properly executed exemption certificates are

deemed to be taxable retail sales. In this situation, the burden of proof that the tax was not required to be collected

is upon the seller.

3.

Retention of Certificates - Certificates must be retained by the seller for a period of not less than four years from the

date of the sale covered by the certificate.

EXAMPLES OF PROPER USE OF RESALE CERTIFICATE FOR NON-NEW JERSEY SELLERS

(a) A craftsman registered in Pennsylvania as a retail and wholesale seller of furniture comes to New Jersey to

purchase lumber which he will use in making furniture.

(b) A merchant registered as a retail seller of books in Connecticut purchases books for his inventory from a New

Jersey dealer and sends his employee to pick up the merchandise.

(c) A computer store owner registered as a retailer in Wisconsin purchases canned software for her inventory

while attending a trade show in New Jersey, and carries it away from the show herself.

EXAMPLES OF IMPROPER USE OF RESALE CERTIFICATE FOR NON-NEW JERSEY SELLERS

(a) A lumber dealer may not accept an ST-3NR from a contractor who intends to use it in working on his

customers’ real property, because under New Jersey law, contractors are considered to be the retail purchasers

of the construction materials that they use.

(b) A bookseller may not accept an ST-3NR from a doctor who is purchasing books for patients to read in her

waiting room, because this would not be a purchase for resale.

(c) A candy wholesaler may not accept an ST-3NR from a purchaser who shows a New Jersey store address on

the form, because this information would give the seller reason to believe that the purchaser should be

registered in New Jersey.

(d) A plant nursery may not accept an ST-3NR from a New York florist who requests delivery of the plants by

common carrier to his New York location, because this would not be a New Jersey sale.

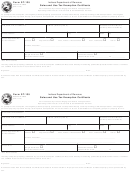

Private reproduction of both sides of resale

REPRODUCTION OF RESALE CERTIFICATE FORMS:

certificates may be made without the prior permission of the Division of Taxation.

FOR MORE INFORMATION:

Call the Customer Service Center (609) 292-6400. Send an e-mail to nj.taxation@treas.state.nj.us. Write to: New

Jersey Division of Taxation, Information and Publications Branch, PO Box 281, Trenton, NJ 08695-0281.

1

1 2

2