Form 1038 - Rental Income Worksheet - Norcom Partners

ADVERTISEMENT

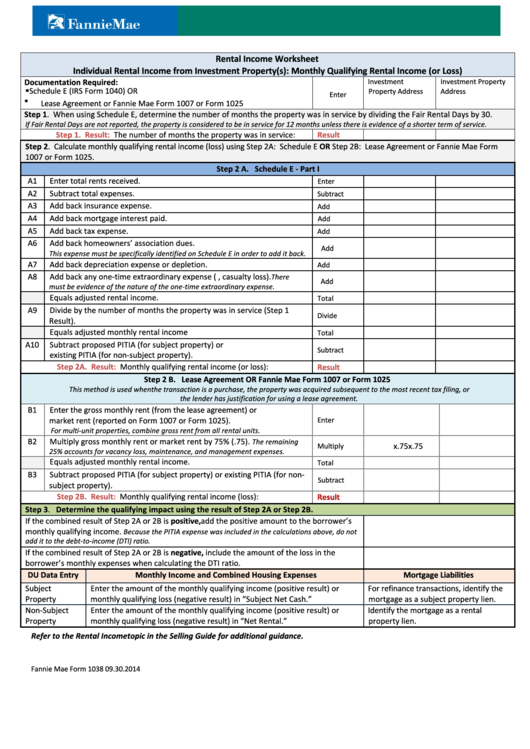

Rental Income Worksheet

Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss)

Investment

Investment Property

Documentation Required:

Property Address

Address

Schedule E (IRS Form 1040) OR

Enter

Lease Agreement or Fannie Mae Form 1007 or Form 1025

Step 1. When using Schedule E, determine the number of months the property was in service by dividing the Fair Rental Days by 30.

If Fair Rental Days are not reported, the property is considered to be in service for 12 months unless there is evidence of a shorter term of service.

Step 1. Result:

The number of months the property was in service:

Result

Step 2. Calculate monthly qualifying rental income (loss) using Step 2A: Schedule E OR Step 2B: Lease Agreement or Fannie Mae Form

1007 or Form 1025.

Step 2 A. Schedule E - Part I

A1

Enter total rents received.

Enter

A2

Subtract total expenses.

Subtract

A3

Add back insurance expense.

Add

A4

Add back mortgage interest paid.

Add

A5

Add back tax expense.

Add

A6

Add back homeowners’ association dues.

Add

This expense must be specifically identified on Schedule E in order to add it back.

A7

Add back depreciation expense or depletion.

Add

A8

Add back any one-time extraordinary expense (e.g., casualty loss).

There

Add

must be evidence of the nature of the one-time extraordinary expense.

Equals adjusted rental income.

Total

A9

Divide by the number of months the property was in service (Step 1

Divide

Result).

Equals adjusted monthly rental income

Total

A10

Subtract proposed PITIA (for subject property) or

Subtract

existing PITIA (for non-subject property).

Step 2A. Result:

Monthly qualifying rental income (or loss):

Result

Step 2 B. Lease Agreement OR Fannie Mae Form 1007 or Form 1025

This method is used when the transaction is a purchase, the property was acquired subsequent to the most recent tax filing, or

the lender has justification for using a lease agreement.

B1

Enter the gross monthly rent (from the lease agreement) or

market rent (reported on Form 1007 or Form 1025).

Enter

For multi-unit properties, combine gross rent from all rental units.

B2

Multiply gross monthly rent or market rent by 75% (.75).

The remaining

x.75

x.75

Multiply

25% accounts for vacancy loss, maintenance, and management expenses.

Equals adjusted monthly rental income.

Total

B3

Subtract proposed PITIA (for subject property) or existing PITIA (for non-

Subtract

subject property).

Step 2B. Result:

Monthly qualifying rental income (loss):

Result

Step 3. Determine the qualifying impact using the result of Step 2A or Step 2B.

If the combined result of Step 2A or 2B is positive, add the positive amount to the borrower’s

monthly qualifying income.

Because the PITIA expense was included in the calculations above, do not

add it to the debt-to-income (DTI) ratio.

If the combined result of Step 2A or 2B is negative, include the amount of the loss in the

borrower’s monthly expenses when calculating the DTI ratio.

DU Data Entry

Monthly Income and Combined Housing Expenses

Mortgage Liabilities

Subject

Enter the amount of the monthly qualifying income (positive result) or

For refinance transactions, identify the

Property

monthly qualifying loss (negative result) in “Subject Net Cash.”

mortgage as a subject property lien.

Non-Subject

Enter the amount of the monthly qualifying income (positive result) or

Identify the mortgage as a rental

Property

monthly qualifying loss (negative result) in “Net Rental.”

property lien.

Refer to the Rental Income topic in the Selling Guide for additional guidance.

Fannie Mae Form 1038

09.30.2014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1