Capital Gains Tax (Cgt) Schedule - 2016

ADVERTISEMENT

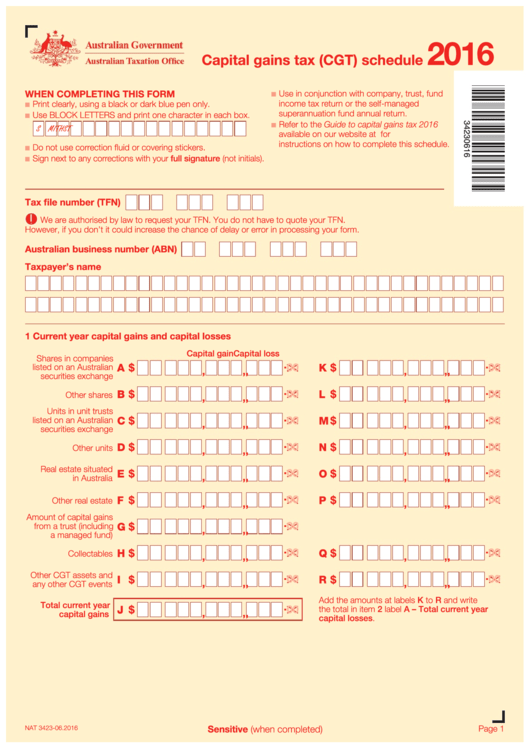

2016

Capital gains tax (CGT) schedule

WHEN COMPLETING THIS FORM

Use in conjunction with company, trust, fund

n

income tax return or the self-managed

Print clearly, using a black or dark blue pen only.

n

superannuation fund annual return.

Use BLOCK LETTERS and print one character in each box.

n

Refer to the Guide to capital gains tax 2016

n

S M I

T H

S T

available on our website at ato.gov.au for

instructions on how to complete this schedule.

Do not use correction fluid or covering stickers.

n

Sign next to any corrections with your full signature (not initials).

n

Tax file number (TFN)

We are authorised by law to request your TFN. You do not have to quote your TFN.

However, if you don’t it could increase the chance of delay or error in processing your form.

Australian business number (ABN)

Taxpayer’s name

1

Current year capital gains and capital losses

Capital gain

Capital loss

Shares in companies

.

.

00

00

$

$

listed on an Australian

A

K

,

,

,

,

,

,

securities exchange

.

.

00

00

$

$

B

L

Other shares

,

,

,

,

,

,

Units in unit trusts

.

.

00

00

$

$

listed on an Australian

C

M

,

,

,

,

,

,

securities exchange

.

.

00

00

$

$

D

N

Other units

,

,

,

,

,

,

.

.

Real estate situated

00

00

$

$

E

O

,

,

,

,

,

,

in Australia

.

.

00

00

$

$

F

P

Other real estate

,

,

,

,

,

,

Amount of capital gains

.

00

$

from a trust (including

G

,

,

,

a managed fund)

.

.

00

00

$

$

H

Q

Collectables

,

,

,

,

,

,

.

.

Other CGT assets and

00

00

$

$

I

R

,

,

,

,

,

,

any other CGT events

Add the amounts at labels K to R and write

.

Total current year

00

$

J

the total in item 2 label A – Total current year

,

,

,

capital gains

capital losses.

Sensitive (when completed)

Page 1

NAT 3423-06.2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4