Instructions And Worksheet For Form W-4 Maryland

ADVERTISEMENT

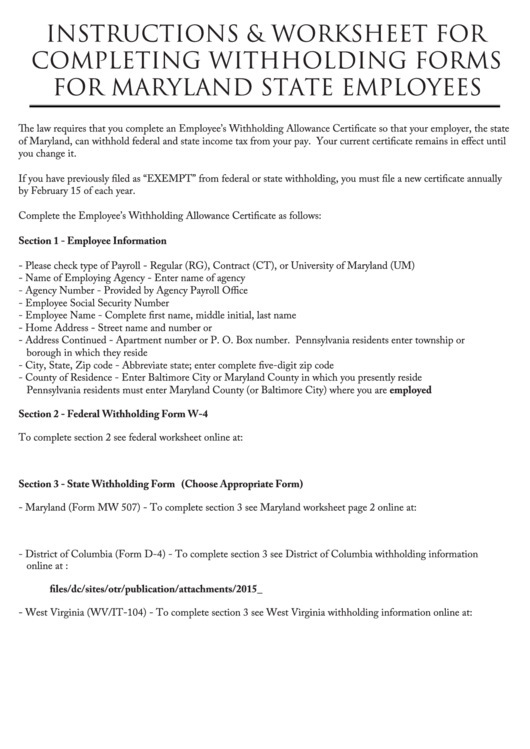

INSTRUCTIONS & WORKSHEET FOR

COMPLETING WITHHOLDING FORMS

FOR MARYLAND STATE EMPLOYEES

The law requires that you complete an Employee’s Withholding Allowance Certificate so that your employer, the state

of Maryland, can withhold federal and state income tax from your pay. Your current certificate remains in effect until

you change it.

If you have previously filed as “EXEMPT” from federal or state withholding, you must file a new certificate annually

by February 15 of each year.

Complete the Employee’s Withholding Allowance Certificate as follows:

Section 1 - Employee Information

- Please check type of Payroll - Regular (RG), Contract (CT), or University of Maryland (UM)

- Name of Employing Agency - Enter name of agency

- Agency Number - Provided by Agency Payroll Office

- Employee Social Security Number

- Employee Name - Complete first name, middle initial, last name

- Home Address - Street name and number or R.D. number

- Address Continued - Apartment number or P. O. Box number. Pennsylvania residents enter township or

borough in which they reside

- City, State, Zip code - Abbreviate state; enter complete five-digit zip code

- County of Residence - Enter Baltimore City or Maryland County in which you presently reside

Pennsylvania residents must enter Maryland County (or Baltimore City) where you are employed

Section 2 - Federal Withholding Form W-4

To complete section 2 see federal worksheet online at:

Section 3 - State Withholding Form (Choose Appropriate Form)

- Maryland (Form MW 507) - To complete section 3 see Maryland worksheet page 2 online at:

- District of Columbia (Form D-4) - To complete section 3 see District of Columbia withholding information

online at :

- West Virginia (WV/IT-104) - To complete section 3 see West Virginia withholding information online at:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4