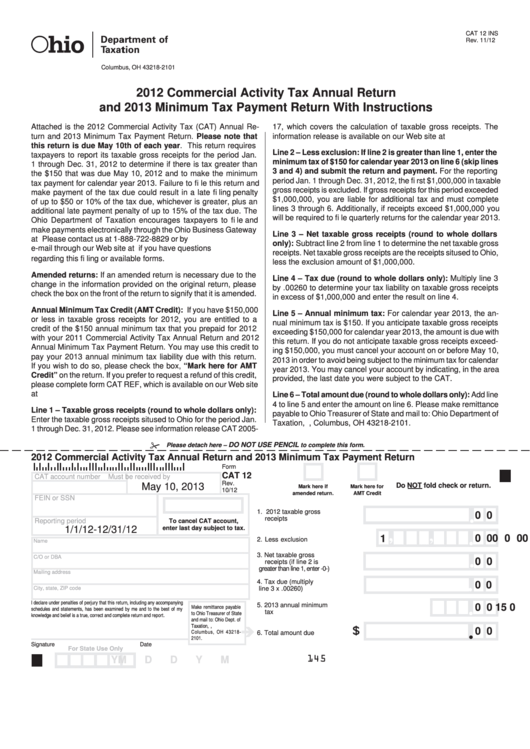

Form Cat 12 - 2012 Commercial Activity Tax Annual Return And 2013 Minimum Tax Payment Return

ADVERTISEMENT

CAT 12 INS

Rev. 11/12

P.O. Box 182101

Columbus, OH 43218-2101

tax.ohio.gov

2012 Commercial Activity Tax Annual Return

and 2013 Minimum Tax Payment Return With Instructions

Attached is the 2012 Commercial Activity Tax (CAT) Annual Re-

17, which covers the calculation of taxable gross receipts. The

turn and 2013 Minimum Tax Payment Return. Please note that

information release is available on our Web site at tax.ohio.gov.

this return is due May 10th of each year. This return requires

Line 2 – Less exclusion: If line 2 is greater than line 1, enter the

taxpayers to report its taxable gross receipts for the period Jan.

minimum tax of $150 for calendar year 2013 on line 6 (skip lines

1 through Dec. 31, 2012 to determine if there is tax greater than

3 and 4) and submit the return and payment. For the reporting

the $150 that was due May 10, 2012 and to make the minimum

period Jan. 1 through Dec. 31, 2012, the fi rst $1,000,000 in taxable

tax payment for calendar year 2013. Failure to fi le this return and

gross receipts is excluded. If gross receipts for this period exceeded

make payment of the tax due could result in a late fi ling penalty

$1,000,000, you are liable for additional tax and must complete

of up to $50 or 10% of the tax due, whichever is greater, plus an

lines 3 through 6. Additionally, if receipts exceed $1,000,000 you

additional late payment penalty of up to 15% of the tax due. The

will be required to fi le quarterly returns for the calendar year 2013.

Ohio Department of Taxation encourages taxpayers to fi le and

make payments electronically through the Ohio Business Gateway

Line 3 – Net taxable gross receipts (round to whole dollars

at business.ohio.gov. Please contact us at 1-888-722-8829 or by

only): Subtract line 2 from line 1 to determine the net taxable gross

e-mail through our Web site at tax.ohio.gov if you have questions

receipts. Net taxable gross receipts are the receipts sitused to Ohio,

regarding this fi ling or available forms.

less the exclusion amount of $1,000,000.

Amended returns: If an amended return is necessary due to the

Line 4 – Tax due (round to whole dollars only): Multiply line 3

change in the information provided on the original return, please

by .00260 to determine your tax liability on taxable gross receipts

check the box on the front of the return to signify that it is amended.

in excess of $1,000,000 and enter the result on line 4.

Annual Minimum Tax Credit (AMT Credit): If you have $150,000

Line 5 – Annual minimum tax: For calendar year 2013, the an-

or less in taxable gross receipts for 2012, you are entitled to a

nual minimum tax is $150. If you anticipate taxable gross receipts

credit of the $150 annual minimum tax that you prepaid for 2012

exceeding $150,000 for calendar year 2013, the amount is due with

with your 2011 Commercial Activity Tax Annual Return and 2012

this return. If you do not anticipate taxable gross receipts exceed-

Annual Minimum Tax Payment Return. You may use this credit to

ing $150,000, you must cancel your account on or before May 10,

pay your 2013 annual minimum tax liability due with this return.

2013 in order to avoid being subject to the minimum tax for calendar

If you wish to do so, please check the box, “Mark here for AMT

year 2013. You may cancel your account by indicating, in the area

Credit” on the return. If you prefer to request a refund of this credit,

provided, the last date you were subject to the CAT.

please complete form CAT REF, which is available on our Web site

at tax.ohio.gov.

Line 6 – Total amount due (round to whole dollars only): Add line

4 to line 5 and enter the amount on line 6. Please make remittance

Line 1 – Taxable gross receipts (round to whole dollars only):

payable to Ohio Treasurer of State and mail to: Ohio Department of

Enter the taxable gross receipts sitused to Ohio for the period Jan.

Taxation, P.O. Box 182101, Columbus, OH 43218-2101.

1 through Dec. 31, 2012. Please see information release CAT 2005-

Reset Form

DO NOT USE PENCIL

Please detach here –

to complete this form.

2012 Commercial Activity Tax Annual Return and 2013 Minimum Tax Payment Return

Form

CAT 12

CAT account number

Must be received by

Rev.

May 10, 2013

Do NOT fold check or return.

Mark here if

Mark here for

10/12

amended return.

AMT Credit

FEIN or SSN

1. 2012 taxable gross

0 0

receipts

Reporting period

To cancel CAT account,

1/1/12-12/31/12

enter last day subject to tax.

,

,

,

0 0 0

0 0 0

0 0

1

2. Less exclusion

Name

,

3. Net taxable gross

C/O or DBA

0 0

receipts (if line 2 is

greater than line 1, enter -0-)

Mailing address

,

,

4. Tax due (multiply

0 0

City, state, ZIP code

line 3 x .00260)

I declare under penalties of perjury that this return, including any accompanying

5. 2013 annual minimum

1 5 0

0 0

Make remittance payable

schedules and statements, has been examined by me and to the best of my

tax

to Ohio Treasurer of State

knowledge and belief is a true, correct and complete return and report.

and mail to: Ohio Dept. of

Taxation, P.O. Box 182101,

$

0 0

Columbus, OH 43218-

6. Total amount due

2101.

Signature

Date

For State Use Only

145

M

M

D D

Y

Y

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1