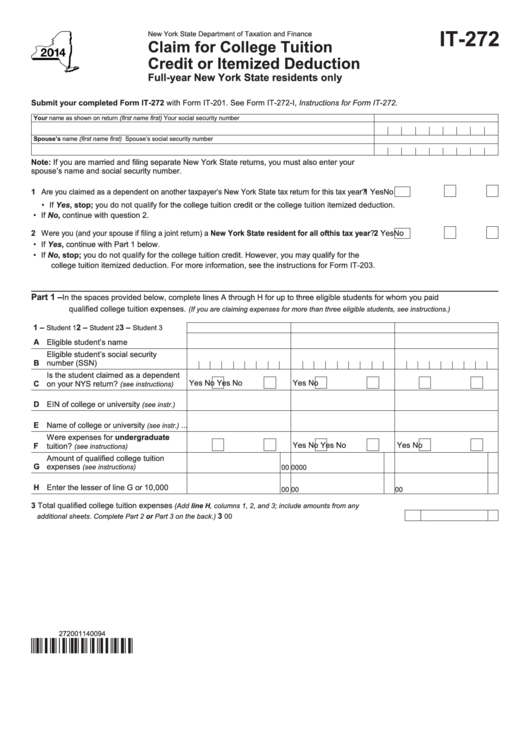

Form It-272, 2014, Claim For College Tuition Credit

ADVERTISEMENT

IT-272

New York State Department of Taxation and Finance

Claim for College Tuition

Credit or Itemized Deduction

Full-year New York State residents only

Submit your completed Form IT-272 with Form IT-201. See Form IT-272-I, Instructions for Form IT-272.

Your name as shown on return (first name first)

Your social security number

Spouse’s name (first name first)

Spouse’s social security number

Note: If you are married and filing separate New York State returns, you must also enter your

spouse’s name and social security number.

1 Are you claimed as a dependent on another taxpayer’s New York State tax return for this tax year? ............

1

Yes

No

• If Yes, stop; you do not qualify for the college tuition credit or the college tuition itemized deduction.

• If No, continue with question 2.

2 Were you (and your spouse if filing a joint return) a New York State resident for all of this tax year? .......

2

Yes

No

• If Yes, continue with Part 1 below.

• If No, stop; you do not qualify for the college tuition credit. However, you may qualify for the

college tuition itemized deduction. For more information, see the instructions for Form IT-203.

Part 1 –

In the spaces provided below, complete lines A through H for up to three eligible students for whom you paid

q ualified college tuition expenses.

(If you are claiming expenses for more than three eligible students, see instructions.)

1 –

2 –

3 –

Student 1

Student 2

Student 3

A

Eligible student’s name ..........................

Eligible student’s social security

B

number (SSN) ........................................

Is the student claimed as a dependent

Yes

No

Yes

No

Yes

No

C

on your NYS return?

.....

(see instructions)

D

EIN of college or university

....

(see instr.)

E

Name of college or university

...

(see instr.)

Were expenses for undergraduate

Yes

No

Yes

No

Yes

No

F

tuition?

..........................

(see instructions)

Amount of qualified college tuition

G

expenses

......................

(see instructions)

00

00

00

H

Enter the lesser of line G or 10,000 ......

00

00

00

3 Total qualified college tuition expenses

(Add line H, columns 1, 2, and 3; include amounts from any

...............................................................................

3

00

additional sheets. Complete Part 2 or Part 3 on the back.)

272001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2