Preliminary Change Of Ownership

Download a blank fillable Preliminary Change Of Ownership in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Preliminary Change Of Ownership with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

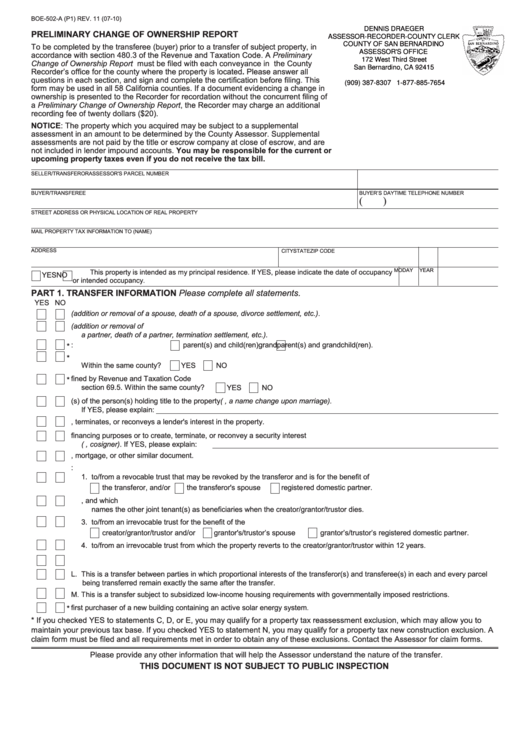

BOE-502-A (P1) REV. 11 (07-10)

DENNIS DRAEGER

PRELIMINARY CHANGE OF OWNERSHIP REPORT

ASSESSOR-RECORDER-COUNTY CLERK

COUNTY OF SAN BERNARDINO

To be completed by the transferee (buyer) prior to a transfer of subject property, in

ASSESSOR'S OFFICE

accordance with section 480.3 of the Revenue and Taxation Code. A Preliminary

172 West Third Street

Change of Ownership Report must be filed with each conveyance in the County

San Bernardino, CA 92415

Recorder’s office for the county where the property is located. Please answer all

questions in each section, and sign and complete the certification before filing. This

(909) 387-8307 1-877-885-7654

form may be used in all 58 California counties. If a document evidencing a change in

ownership is presented to the Recorder for recordation without the concurrent filing of

a Preliminary Change of Ownership Report, the Recorder may charge an additional

recording fee of twenty dollars ($20).

NOTICE: The property which you acquired may be subject to a supplemental

assessment in an amount to be determined by the County Assessor. Supplemental

assessments are not paid by the title or escrow company at close of escrow, and are

not included in lender impound accounts. You may be responsible for the current or

upcoming property taxes even if you do not receive the tax bill.

SELLER/TRANSFEROR

ASSESSOR'S PARCEL NUMBER

BUYER/TRANSFEREE

BUYER’S DAYTIME TELEPHONE NUMBER

(

)

STREET ADDRESS OR PHYSICAL LOCATION OF REAL PROPERTY

MAIL PROPERTY TAX INFORMATION TO (NAME)

ADDRESS

CITY

STATE ZIP CODE

MO

DAY

YEAR

This property is intended as my principal residence. If YES, please indicate the date of occupancy

YES

NO

or intended occupancy.

PART 1. TRANSFER INFORMATION

Please complete all statements.

YES NO

A. This transfer is solely between spouses (addition or removal of a spouse, death of a spouse, divorce settlement, etc.).

B. This transfer is solely between domestic partners currently registered with the California Secretary of State (addition or removal of

a partner, death of a partner, termination settlement, etc.).

C. This is a transfer between:

parent(s) and child(ren)

grandparent(s) and grandchild(ren).

*

D. This transaction is to replace a principal residence by a person 55 years of age or older.

*

Within the same county?

YES

NO

E. This transaction is to replace a principal residence by a person who is severely disabled as defined by Revenue and Taxation Code

*

section 69.5. Within the same county?

YES

NO

F. This transaction is only a correction of the name(s) of the person(s) holding title to the property (e.g., a name change upon marriage).

If YES, please explain:

G. The recorded document creates, terminates, or reconveys a lender's interest in the property.

H. This transaction is recorded only as a requirement for financing purposes or to create, terminate, or reconvey a security interest

(e.g., cosigner). If YES, please explain:

I. The recorded document substitutes a trustee of a trust, mortgage, or other similar document.

J. This is a transfer of property:

1. to/from a revocable trust that may be revoked by the transferor and is for the benefit of

the transferor, and/or

the transferor's spouse

registe

red domestic partner.

2. to/from a trust that may be revoked by the creator/grantor/trustor who is also a joint tenant, and which

names the other joint tenant(s) as beneficiaries when the creator/grantor/trustor dies.

3. to/from an irrevocable trust for the benefit of the

creator/grantor/trustor and/or

grantor's/trustor’s spouse

grantor’s/trustor’s registered domestic partner.

4. to/from an irrevocable trust from which the property reverts to the creator/grantor/trustor within 12 years.

K. This property is subject to a lease with a remaining lease term of 35 years or more including written options.

L. This is a transfer between parties in which proportional interests of the transferor(s) and transferee(s) in each and every parcel

being transferred remain exactly the same after the transfer.

M. This is a transfer subject to subsidized low-income housing requirements with governmentally imposed restrictions.

N. This transfer is to the first purchaser of a new building containing an active solar energy system.

*

* If you checked YES to statements C, D, or E, you may qualify for a property tax reassessment exclusion, which may allow you to

maintain your previous tax base. If you checked YES to statement N, you may qualify for a property tax new construction exclusion. A

claim form must be filed and all requirements met in order to obtain any of these exclusions. Contact the Assessor for claim forms.

Please provide any other information that will help the Assessor understand the nature of the transfer.

THIS DOCUMENT IS NOT SUBJECT TO PUBLIC INSPECTION

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2