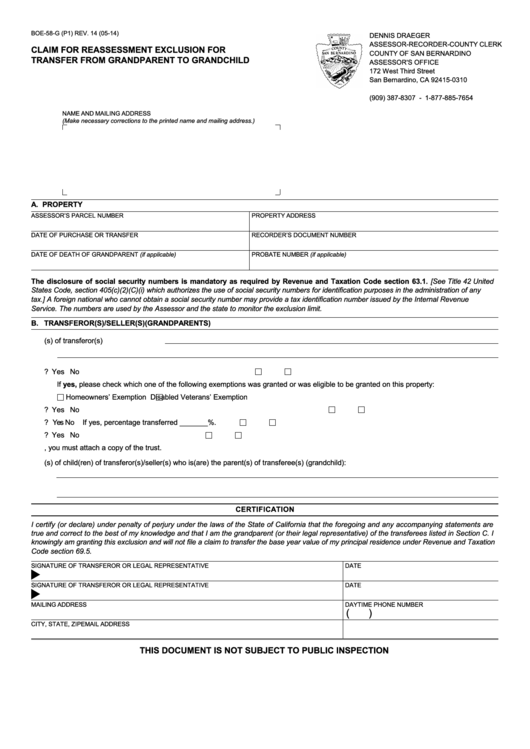

BOE-58-G (P1) REV. 14 (05-14)

DENNIS DRAEGER

ASSESSOR-RECORDER-COUNTY CLERK

CLAIM FOR REASSESSMENT EXCLUSION FOR

COUNTY OF SAN BERNARDINO

TRANSFER FROM GRANDPARENT TO GRANDCHILD

ASSESSOR'S OFFICE

172 West Third Street

San Bernardino, CA 92415-0310

(909) 387-8307 - 1-877-885-7654

NAME AND MAILING ADDRESS

(Make necessary corrections to the printed name and mailing address.)

A. PROPERTY

ASSESSOR’S PARCEL NUMBER

PROPERTY ADDRESS

DATE OF PURCHASE OR TRANSFER

RECORDER’S DOCUMENT NUMBER

DATE OF DEATH OF GRANDPARENT (if applicable)

PROBATE NUMBER (if applicable)

The disclosure of social security numbers is mandatory as required by Revenue and Taxation Code section 63.1. [See Title 42 United

States Code, section 405(c)(2)(C)(i) which authorizes the use of social security numbers for identification purposes in the administration of any

tax.] A foreign national who cannot obtain a social security number may provide a tax identification number issued by the Internal Revenue

Service. The numbers are used by the Assessor and the state to monitor the exclusion limit.

B. TRANSFEROR(S)/SELLER(S) (GRANDPARENTS)

1. Print full name(s) of transferor(s)

2. Was this property the principal residence of the transferor?

Yes

No

If yes, please check which one of the following exemptions was granted or was eligible to be granted on this property:

Homeowners’ Exemption

Disabled Veterans’ Exemption

3. Was real property other than the principal residence of the transferor transferred?

Yes

No

4. Was only a partial interest in the property transferred?

Yes

No

If yes, percentage transferred _______%.

5. Did you own this property as a joint tenant?

Yes

No

6. If the transfer was through the medium of a trust, you must attach a copy of the trust.

7. Print name(s) of child(ren) of transferor(s)/seller(s) who is(are) the parent(s) of transferee(s) (grandchild):

CERTIFICATION

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing and any accompanying statements are

true and correct to the best of my knowledge and that I am the grandparent (or their legal representative) of the transferees listed in Section C. I

knowingly am granting this exclusion and will not file a claim to transfer the base year value of my principal residence under Revenue and Taxation

Code section 69.5.

SIGNATURE OF TRANSFEROR OR LEGAL REPRESENTATIVE

DATE

t

SIGNATURE OF TRANSFEROR OR LEGAL REPRESENTATIVE

DATE

t

MAILING ADDRESS

DAYTIME PHONE NUMBER

(

)

CITY, STATE, ZIP

EMAIL ADDRESS

THIS DOCUMENT IS NOT SUBJECT TO PUBLIC INSPECTION

1

1 2

2 3

3