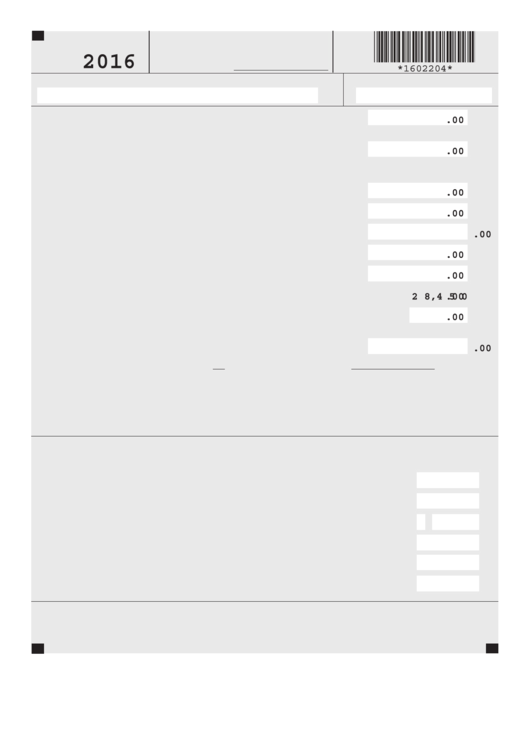

Schedule 2 - Form 1040me - Itemized Deductions

ADVERTISEMENT

ITEMIZED DEDUCTIONS

SCHEDULE 2

FORM 1040ME

for Form 1040ME, line 17

99

Enclose with Form 1040ME

2016

Attachment

6

For more information, visit

Sequence No.

*1602204*

Name(s) as shown on Form 1040ME

Your Social Security Number

1

1

Total itemized deductions from federal Form 1040, Schedule A, line 29 ......................................

.00

2 a

Income taxes imposed by this state or any other taxing jurisdiction or general sales

2a

taxes included in line 1 above from federal Form 1040, Schedule A, line 5 ............................

.00

Complete the worksheet below if Form 1040ME, line 14 exceeds $311,300 if married

ling

fi

jointly, $285,350 if head-of-household, $259,400 if single or $155,650 if married

ling separately.

fi

b

Deductible costs, included in line 1 above, incurred in the production of

2b

Maine exempt income ..........................................................................................................

.00

c

Amount included in line 1 attributable to income from an ownership interest in a

2c

pass-through entity

nancial institution ................................................................................

.00

fi

d

Medical and dental expenses included in line 1 above from federal Form 1040,

2d

Schedule A, line 4 .................................................................................................................

.00

3

Deductible costs of producing income exempt from federal income tax, but taxable by

3

Maine ............................................................................................................................................

.00

4

4

Line 1 minus lines 2a, b, c, and d plus line 3. .................................................................................

.00

5

5

Maximum allowable itemized deduction .......................................................................................

.00

2 8,4 5 0

6

6

Enter the smaller of line 4 or line 5 ...............................................................................................

.00

7

Add line 2d (less any amount used to claim the Adult Dependent Care Credit on

Form 1040ME, Schedule A, lines 2 and 9) and line 6. Enter the result here and on

*

7

Form 1040ME, line 17

.................................................................................................................

.00

*NOTE: If the amount on line 7 above is less than your allowable standard deduction, use the standard deduction.

If Married Filing Separately, however, both spouses must either itemize or use the standard deduction.

CAUTION: Your deduction, on line 7 above may be limited. You must complete the Worksheet for Standard / Itemized Deductions (for Form

1040ME, line 17) to calculate your reduced deduction amount if the amount on Form 1040ME, line 16 is more than $70,000 if single or married

ling separately; $105,000 if head of household; or $140,000 if married

ling jointly or qualifying widow(er).

fi

fi

2016 Worksheet for Maine Schedule 2, line 2a

For individuals whose federal adjusted gross income exceeds $311,300 if married

ling jointly or qualifying widow(er), $285,350 if head-of-household,

fi

$259,400 if single or $155,650 if married

ling separately.

fi

1

1

Enter total state and local income taxes or sales taxes (from federal Schedule A, line 5). ............................................

$

2

Enter federal itemized deductions subject to reduction (from federal itemized deductions

2

worksheet, line 3). ........................................................................................................................................................

$

.

3

3

Divide line 1 by line 2. Calculate to four decimals. Enter result here. ...........................................................................

4

4

Enter federal itemized deductions disallowed (from federal itemized deductions worksheet, line 9). ......................................

$

5

5

Multiply line 4 by line 3. Enter result here .......................................................................................................................

$

6

6

Subtract line 5 from line 1. Enter result here and on Schedule 2, line 2a ......................................................................

$

19

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1