Small Business Identity Theft Checklist

ADVERTISEMENT

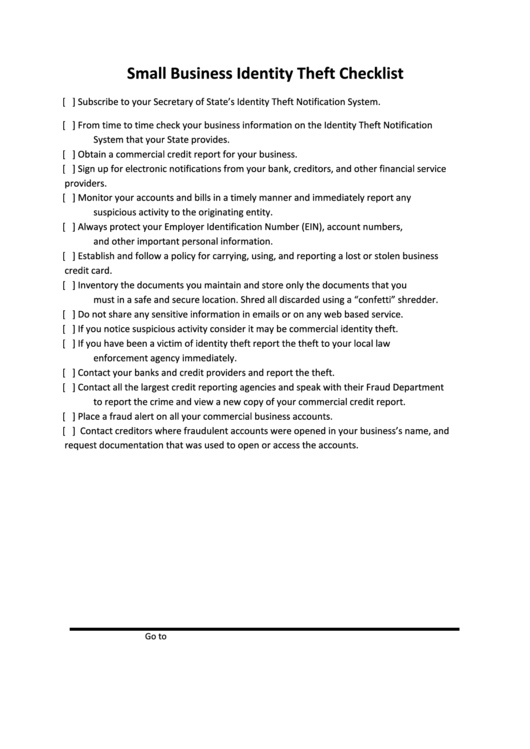

Small Business Identity Theft Checklist

[ ]

Subscribe to your Secretary of State’s Identity Theft Notification System.

[ ]

From time to time check your business information on the Identity Theft Notification

System that your State provides.

[ ]

Obtain a commercial credit report for your business.

[ ]

Sign up for electronic notifications from your bank, creditors, and other financial service

providers.

[ ]

Monitor your accounts and bills in a timely manner and immediately report any

suspicious activity to the originating entity.

[ ]

Always protect your Employer Identification Number (EIN), account numbers,

and other important personal information.

[ ]

Establish and follow a policy for carrying, using, and reporting a lost or stolen business

credit card.

[ ]

Inventory the documents you maintain and store only the documents that you

must in a safe and secure location. Shred all discarded using a “confetti” shredder.

[ ]

Do not share any sensitive information in emails or on any web based service.

[ ]

If you notice suspicious activity consider it may be commercial identity theft.

[ ]

If you have been a victim of identity theft report the theft to your local law

enforcement agency immediately.

[ ]

Contact your banks and credit providers and report the theft.

[ ]

Contact all the largest credit reporting agencies and speak with their Fraud Department

to report the crime and view a new copy of your commercial credit report.

[ ]

Place a fraud alert on all your commercial business accounts.

[ ]

Contact creditors where fraudulent accounts were opened in your business’s name, and

request documentation that was used to open or access the accounts.

Go to for more free business forms

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1