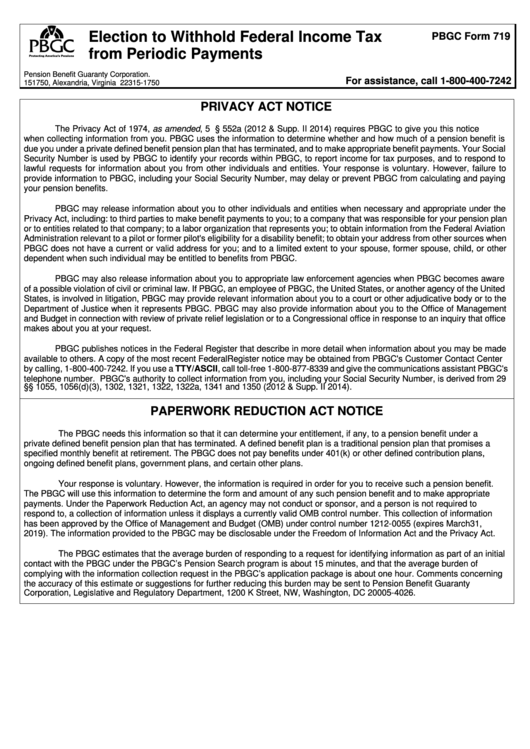

Pbgc Form 719 - Election To Withhold Federal Income Tax From Periodic Payments

ADVERTISEMENT

Election to Withhold Federal Income Tax

PBGC Form 719

from Periodic Payments

Pension Benefit Guaranty Corporation.

For assistance, call 1-800-400-7242

P.O. Box 151750, Alexandria, Virginia 22315-1750

PRIVACY ACT NOTICE

The Privacy Act of 1974, as amended, 5 U.S.C. § 552a (2012 & Supp. II 2014) requires PBGC to give you this notice

when collecting information from you. PBGC uses the information to determine whether and how much of a pension benefit is

due you under a private defined benefit pension plan that has terminated, and to make appropriate benefit payments. Your Social

Security Number is used by PBGC to identify your records within PBGC, to report income for tax purposes, and to respond to

lawful requests for information about you from other individuals and entities. Your response is voluntary. However, failure to

provide information to PBGC, including your Social Security Number, may delay or prevent PBGC from calculating and paying

your pension benefits.

PBGC may release information about you to other individuals and entities when necessary and appropriate under the

Privacy Act, including: to third parties to make benefit payments to you; to a company that was responsible for your pension plan

or to entities related to that company; to a labor organization that represents you; to obtain information from the Federal Aviation

Administration relevant to a pilot or former pilot's eligibility for a disability benefit; to obtain your address from other sources when

PBGC does not have a current or valid address for you; and to a limited extent to your spouse, former spouse, child, or other

dependent when such individual may be entitled to benefits from PBGC.

PBGC may also release information about you to appropriate law enforcement agencies when PBGC becomes aware

of a possible violation of civil or criminal law. If PBGC, an employee of PBGC, the United States, or another agency of the United

States, is involved in litigation, PBGC may provide relevant information about you to a court or other adjudicative body or to the

Department of Justice when it represents PBGC. PBGC may also provide information about you to the Office of Management

and Budget in connection with review of private relief legislation or to a Congressional office in response to an inquiry that office

makes about you at your request.

PBGC publishes notices in the Federal Register that describe in more detail when information about you may be made

available to others. A copy of the most recent Federal Register notice may be obtained from PBGC's Customer Contact Center

by calling, 1-800-400-7242. If you use a TTY/ASCII, call toll-free 1-800-877-8339 and give the communications assistant PBGC's

telephone number. PBGC's authority to collect information from you, including your Social Security Number, is derived from 29

U.S.C. §§ 1055, 1056(d)(3), 1302, 1321, 1322, 1322a, 1341 and 1350 (2012 & Supp. II 2014).

PAPERWORK REDUCTION ACT NOTICE

The PBGC needs this information so that it can determine your entitlement, if any, to a pension benefit under a

private defined benefit pension plan that has terminated. A defined benefit plan is a traditional pension plan that promises a

specified monthly benefit at retirement. The PBGC does not pay benefits under 401(k) or other defined contribution plans,

ongoing defined benefit plans, government plans, and certain other plans.

Your response is voluntary. However, the information is required in order for you to receive such a pension benefit.

The PBGC will use this information to determine the form and amount of any such pension benefit and to make appropriate

payments. Under the Paperwork Reduction Act, an agency may not conduct or sponsor, and a person is not required to

respond to, a collection of information unless it displays a currently valid OMB control number. This collection of information

has been approved by the Office of Management and Budget (OMB) under control number 1212-0055 (expires March 31,

2019). The information provided to the PBGC may be disclosable under the Freedom of Information Act and the Privacy Act.

The PBGC estimates that the average burden of responding to a request for identifying information as part of an initial

contact with the PBGC under the PBGC’s Pension Search program is about 15 minutes, and that the average burden of

complying with the information collection request in the PBGC’s application package is about one hour. Comments concerning

the accuracy of this estimate or suggestions for further reducing this burden may be sent to Pension Benefit Guaranty

Corporation, Legislative and Regulatory Department, 1200 K Street, NW, Washington, DC 20005-4026.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3