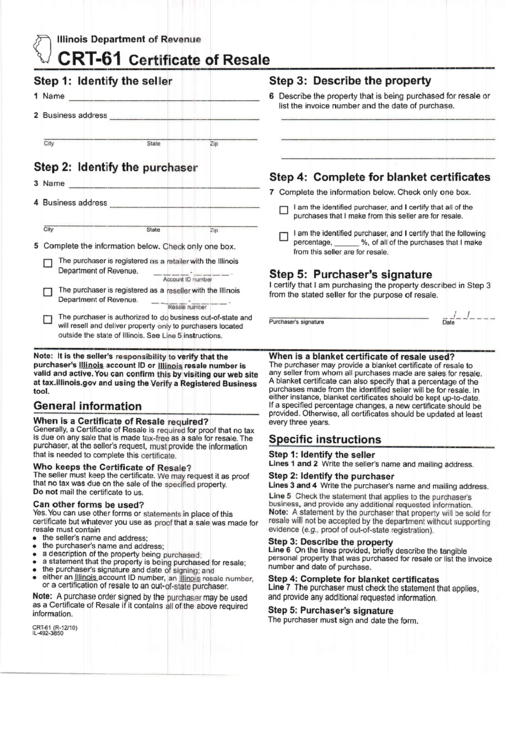

Form Crt-61 - Certificate Of Resale - Illinois

ADVERTISEMENT

fl

lllinois Department

\^/ rCRf-61 Gr+

Step 1: ldentiiit the sel

1 Name

2 Business adrjress

Step 2: ldentiifll the

3 Narne

4 Business adrjress

City

Slate

5 Complete the information belcrw.

;-1 The purchaser is registered r

-

)spartment of Revenue.

f-'l The purclraser is reoistered as a

t_J

Department of Relvenue.

J-1 lhe purchaser is authorized to

-

will resell and cleliver property

is due on any sark; thert is made t;

purcha$er, at the seller's requesrt,

or a certification of resale to iln ,out-

Note: l\ purcharse

onler signed by the

as a Certificate ol Resale if it contarins

cate of Resale

onlr/ one box.

with the lllinois

witth the lllinois

Step 3: Describe the property

6 Describe the property that is being purchased for resale or

list the invoice number and the date of purchase.

Step 4: Gomplete for blanket certi'ficates

7 Complete the information below. Check only'one box.

;--1 | am the identified purchaser, and I certify that all

'of the

-

purchases that I make from this seller are for resale.

n

I am the identified purchaser, and I certify that the following

-

percentage, __

Yo, of all of the purchases thart I make

from this seller are lbr resale.

Step 5: Purchaser's signature

I certify that I am purchasing the property desc;ribecl in Step 3

from the stated seller for the purpose of resale.

Purchase/s signature

business out-of-state and

to purchasers located

outside ther state ,of lllinois. See

5 instruciions.

Note: lt is the seller's

verify that the

purchaser's [!ins!s irccount lD or

valid and active.Your can conlirnr

resale number is

at tax.illlinois.gov

and using the

tool.

General infonnation

When is a Certificate of Resale

ired?

Generally, a Certificale of Resale irs

for Droof that no tax

When is a blanket ceftificate of resale used?

The purchaser may provicle a blanket certificate of resirle to

any seller from whom all prurchases made are sales for resale.

A blanket certificate can also specify that a percentager of the

purchases made from the identified seller will be for resale. In

either instance, blanket cerrtificates should be kept up-l,o-date.

lf a specified percentage changes, a new certificate should be

provided. Othenryise, all cerrtificates should be uprJated at least

every three years.

Specific instructions

Step 1: ldentify the seller

Lines 1 and 2 Write the s;ellers name and mailirrg address.

Step 2: ldentify the prurchaser

Lines 3 and 4 Write the purchaser's name and nrailing; address.

Step 3: Describe the property

Line 6 On the lines provicled, briefly describe the tangible

personal property that was purchased for resale or list the invoice

number and date of purchiase.

Step 4: Gomplete for blanket certificates

Line 7 The purchaser must check the statement that erpplies,

and provide any additional

requested

information

Step 5: Purchaser's signature

The purchaser must sign and date thc'form.

t

t

Date

by visiting our web site

a Regis;tered Business

as a sale for resale. The

provide the information

that a sale was made for

that is needed to compk:te this

Who keeps tlre Crertificaterof

The seller must keep thr: certific;ate.

request it as proof

that no tax was rlrre on lhe sale of tht>

Do not mail the certificerte to us.

puoperty.

Gan other forms lte usediD

Yes. You can use other forms or

in place of this

certificate but wlratevr:r vou use as

resale rnust contain

o the seller's nerrne ancl address;

o the purchaser's name and address:

r a description of ther property beingt

. a statement thiet the property is ber

purchasied for resale;

r the purchaser's signarture and d.ate

o either an lllinqitaccount lD numrberr.

;lurchaser.

may be used

information.

cRT-61 (R-12y10)

r1492-3850

of the erbove reouired

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1