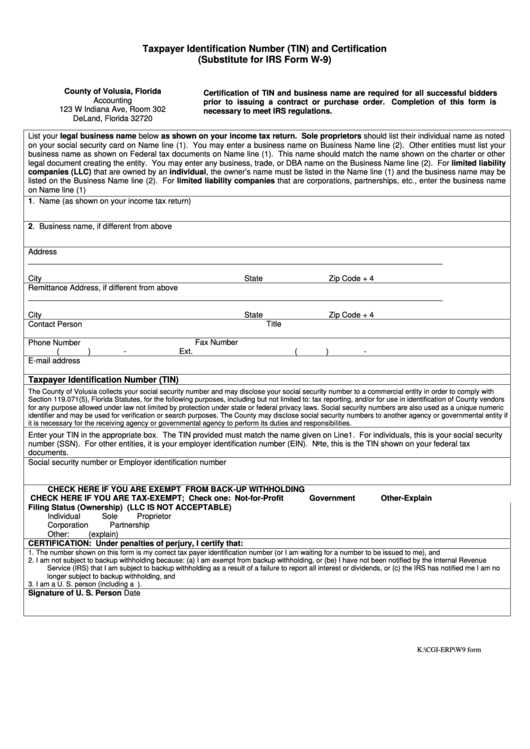

Taxpayer Identification Number (TIN) and Certification

(Substitute for IRS Form W-9)

COMPLETE BOTH SIDES OF FORM

County of Volusia, Florida

Certification of TIN and business name are required for all successful bidders

Accounting

prior to issuing a contract or purchase order.

Completion of this form is

123 W Indiana Ave, Room 302

necessary to meet IRS regulations.

DeLand, Florida 32720

List your legal business name below as shown on your income tax return. Sole proprietors should list their individual name as noted

on your social security card on Name line (1). You may enter a business name on Business Name line (2). Other entities must list your

business name as shown on Federal tax documents on Name line (1). This name should match the name shown on the charter or other

legal document creating the entity. You may enter any business, trade, or DBA name on the Business Name line (2). For limited liability

companies (LLC) that are owned by an individual, the owner’s name must be listed in the Name line (1) and the business name may be

listed on the Business Name line (2). For limited liability companies that are corporations, partnerships, etc., enter the business name

on Name line (1)

1. Name (as shown on your income tax return)

2. Business name, if different from above

Address

_______________________________________________________________________________________________

City

State

Zip Code + 4

Remittance Address, if different from above

_______________________________________________________________________________________________

City

State

Zip Code + 4

Contact Person

Title

Phone Number

Fax Number

(

)

-

Ext.

(

)

-

E-mail address

Taxpayer Identification Number (TIN)

The County of Volusia collects your social security number and may disclose your social security number to a commercial entity in order to comply with

Section 119.071(5), Florida Statutes, for the following purposes, including but not limited to: tax reporting, and/or for use in identification of County vendors

for any purpose allowed under law not limited by protection under state or federal privacy laws. Social security numbers are also used as a unique numeric

identifier and may be used for verification or search purposes. The County may disclose social security numbers to another agency or governmental entity if

it is necessary for the receiving agency or governmental agency to perform its duties and responsibilities.

Enter your TIN in the appropriate box. The TIN provided must match the name given on Line1. For individuals, this is your social security

number (SSN). For other entities, it is your employer identification number (EIN). Note, this is the TIN shown on your federal tax

documents.

Social security number

or

Employer identification number

CHECK HERE IF YOU ARE EXEMPT FROM BACK-UP WITHHOLDING

CHECK HERE IF YOU ARE TAX-EXEMPT; Check one:

Not-for-Profit

Government

Other-Explain

Filing Status (Ownership) (LLC IS NOT ACCEPTABLE)

Individual

Sole Proprietor

Corporation

Partnership

Other: (explain)

CERTIFICATION: Under penalties of perjury, I certify that:

1.

The number shown on this form is my correct tax payer identification number (or I am waiting for a number to be issued to me), and

2.

I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (be) I have not been notified by the Internal Revenue

Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me I am no

longer subject to backup withholding, and

3.

I am a U. S. person (including a U.S. resident alien).

Signature of U. S. Person

Date

K:\CGI-ERP\W9 form A.doc

1

1