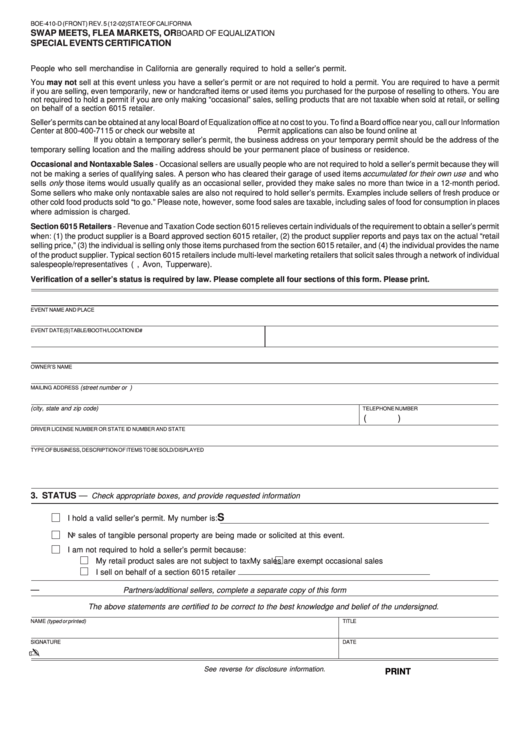

BOE-410-D (FRONT) REV. 5 (12-02)

STATE OF CALIFORNIA

SWAP MEETS, FLEA MARKETS, OR

BOARD OF EQUALIZATION

SPECIAL EVENTS CERTIFICATION

People who sell merchandise in California are generally required to hold a seller’s permit.

You may not sell at this event unless you have a seller’s permit or are not required to hold a permit. You are required to have a permit

if you are selling, even temporarily, new or handcrafted items or used items you purchased for the purpose of reselling to others. You are

not required to hold a permit if you are only making “occasional” sales, selling products that are not taxable when sold at retail, or selling

on behalf of a section 6015 retailer.

Seller’s permits can be obtained at any local Board of Equalization office at no cost to you. To find a Board office near you, call our Information

Center at 800-400-7115 or check our website at Permit applications can also be found online at

sutprograms.htm. If you obtain a temporary seller’s permit, the business address on your temporary permit should be the address of the

temporary selling location and the mailing address should be your permanent place of business or residence.

Occasional and Nontaxable Sales - Occasional sellers are usually people who are not required to hold a seller’s permit because they will

not be making a series of qualifying sales. A person who has cleared their garage of used items accumulated for their own use and who

sells only those items would usually qualify as an occasional seller, provided they make sales no more than twice in a 12-month period.

Some sellers who make only nontaxable sales are also not required to hold seller’s permits. Examples include sellers of fresh produce or

other cold food products sold “to go.” Please note, however, some food sales are taxable, including sales of food for consumption in places

where admission is charged.

Section 6015 Retailers - Revenue and Taxation Code section 6015 relieves certain individuals of the requirement to obtain a seller’s permit

when: (1) the product supplier is a Board approved section 6015 retailer, (2) the product supplier reports and pays tax on the actual “retail

selling price,” (3) the individual is selling only those items purchased from the section 6015 retailer, and (4) the individual provides the name

of the product supplier. Typical section 6015 retailers include multi-level marketing retailers that solicit sales through a network of individual

salespeople/representatives (e.g., Avon, Tupperware).

Verification of a seller’s status is required by law. Please complete all four sections of this form. Please print.

1. EVENT INFORMATION

EVENT NAME AND PLACE

EVENT DATE(S)

TABLE/BOOTH/LOCATION ID#

2. VENDOR/EXHIBITOR INFORMATION

OWNER’S NAME

(street number or P.O. box)

MAILING ADDRESS

(city, state and zip code)

TELEPHONE NUMBER

(

)

DRIVER LICENSE NUMBER OR STATE ID NUMBER AND STATE

TYPE OF BUSINESS, DESCRIPTION OF ITEMS TO BE SOLD/DISPLAYED

3. STATUS —

Check appropriate boxes, and provide requested information

S

I hold a valid seller’s permit. My number is:

No sales of tangible personal property are being made or solicited at this event.

I am not required to hold a seller’s permit because:

My retail product sales are not subject to tax

My sales are exempt occasional sales

I sell on behalf of a section 6015 retailer

4. CERTIFICATION —

Partners/additional sellers, complete a separate copy of this form

The above statements are certified to be correct to the best knowledge and belief of the undersigned.

NAME (typed or printed)

TITLE

SIGNATURE

DATE

See reverse for disclosure information.

CLEAR

PRINT

1

1 2

2