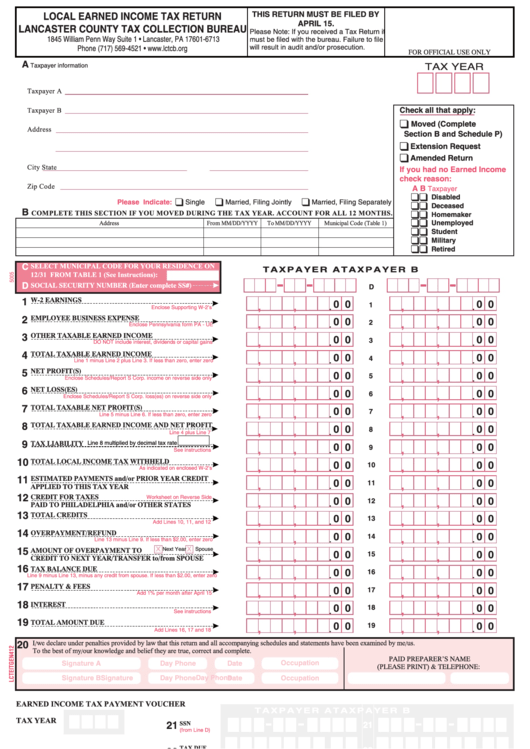

Local Earned Income Tax Return - Lancaster County Tax Collection Bureau

ADVERTISEMENT

THIS RETURN MUST BE FILED BY

LOCAL EARNED INCOME TAX RETURN

APRIL 15.

LANCASTER COUNTY TAX COLLECTION BUREAU

FOR OFFICIAL USE ONLY

A

Taxpayer A

Check all that apply:

Taxpayer B

Moved (Complete

Address

Section B and Schedule P)

Extension Request

Amended Return

City

State

If you had no Earned Income

check reason:

Zip Code

A

B

Disabled

Please Indicate:

Deceased

B

COMPLETE THIS SECTION IF YOU MOVED DURING THE TAX YEAR. ACCOUNT FOR ALL 12 MONTHS.

Homemaker

Unemployed

Address

From MM/DD/YYYY

To MM/DD/YYYY

Municipal Code (Table 1)

Student

Military

Retired

C

SELECT MUNICIPAL CODE FOR YOUR RESIDENCE ON

TA X PAY E R A

TA X PAY E R B

12/31 FROM TABLE 1 (See Instructions):

D

SOCIAL SECURITY NUMBER (Enter complete SS#)

D

1

W-2 EARNINGS

0 0

0 0

1

Enclose Supporting W-2’s

2

EMPLOYEE BUSINESS EXPENSE

0 0

0 0

2

Enclose Pennsylvania form PA - UE

3

OTHER TAXABLE EARNED INCOME

0 0

0 0

3

DO NOT include interest, dividends or capital gains

4

TOTAL TAXABLE EARNED INCOME

0 0

0 0

4

Line 1 minus Line 2 plus Line 3. If less than zero, enter zero

5

NET PROFIT(S)

0 0

0 0

5

Enclose Schedules/Report S Corp. income on reverse side only

6

NET LOSS(ES)

0 0

0 0

6

Enclose Schedules/Report S Corp. loss(es) on reverse side only

7

TOTAL TAXABLE NET PROFIT(S)

0 0

0 0

7

Line 5 minus Line 6. If less than zero, enter zero

8

TOTAL TAXABLE EARNED INCOME AND NET PROFIT

0 0

0 0

8

Line 4 plus Line 7

9

TAX LIABILITY

Line 8 multiplied by decimal tax rate __________.

0 0

0 0

9

See instructions

10

TOTAL LOCAL INCOME TAX WITHHELD

0 0

0 0

10

As indicated on enclosed W-2’s

11

ESTIMATED PAYMENTS and/or PRIOR YEAR CREDIT

0 0

0 0

11

APPLIED TO THIS TAX YEAR

12

CREDIT FOR TAXES

Worksheet on Reverse Side

0 0

0 0

12

PAID TO PHILADELPHIA and/or OTHER STATES

13

TOTAL CREDITS

0 0

0 0

13

Add Lines 10, 11, and 12

14

OVERPAYMENT/REFUND

0 0

0 0

14

Line 13 minus Line 9. If less than $2.00, enter zero

15

AMOUNT OF OVERPAYMENT TO

0 0

0 0

15

CREDIT TO NEXT YEAR/TRANSFER to/from SPOUSE

16

TAX BALANCE DUE

0 0

0 0

16

Line 9 minus Line 13, minus any credit from spouse. If less than $2.00, enter zero

17

PENALTY & FEES

0 0

0 0

17

Add 1% per month after April 15

18

INTEREST

0 0

0 0

18

See instructions

19

TOTAL AMOUNT DUE

0 0

0 0

19

Add Lines 16, 17 and 18

20

I / we declare under penalties provided by law that this return and all accompanying schedules and statements have been examined by me / us.

To the best of my / our knowledge and belief they are true, correct and complete.

PAID PREPARER’S NAME

Occupation

Signature A

Day Phone

Date

(PLEASE PRINT) & TELEPHONE:

Signature B

Day Phone

Date

Occupation

Signature

Day Phone

EARNED INCOME TAX PAYMENT VOUCHER

TA X PAY E R A

TA X PAY E R B

TAX YEAR

21

21

21

SSN

(from Line D)

22

22

22

TAX DUE

(from Line 16)

PENALTY &

23

Taxpayer A

23

23

FEES

(from Line 17)

24

24

24

INTEREST

(from Line 18)

Taxpayer B

25

25

TOTAL DUE

(from Line 19)

PO BOX 11444

submitted with your payment.

40105 00000000000 00000 00 00000000000 000000000 000000 00000000000 0

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2