Property Tax Claim For Refund

Download a blank fillable Property Tax Claim For Refund in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Property Tax Claim For Refund with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

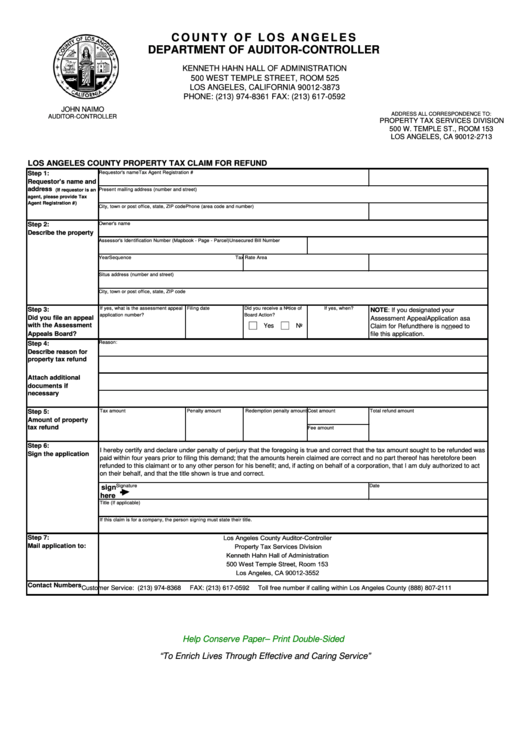

C O U N T Y O F L O S A N G E L E S

DEPARTMENT OF AUDITOR-CONTROLLER

KENNETH HAHN HALL OF ADMINISTRATION

500 WEST TEMPLE STREET, ROOM 525

LOS ANGELES, CALIFORNIA 90012-3873

PHONE: (213) 974-8361 FAX: (213) 617-0592

JOHN NAIMO

ADDRESS ALL CORRESPONDENCE TO:

AUDITOR-CONTROLLER

PROPERTY TAX SERVICES DIVISION

500 W. TEMPLE ST., ROOM 153

LOS ANGELES, CA 90012-2713

LOS ANGELES COUNTY PROPERTY TAX CLAIM FOR REFUND

Requestor's name

Tax Agent Registration #

Step 1:

Requestor's name and

address

Present mailing address (number and street)

(If requestor is an

agent, please provide Tax

Agent Registration #)

City, town or post office, state, ZIP code

Phone (area code and number)

Owner's name

Step 2:

Describe the property

Assessor's Identification Number (Mapbook - Page - Parcel)

Unsecured Bill Number

Year

Sequence

Tax Rate Area

Situs address (number and street)

City, town or post office, state, ZIP code

If yes, what is the assessment appeal

Filing date

Did you receive a Notice of

If yes, when?

Step 3:

NOTE: If you designated your

application number?

Board Action?

Did you file an appeal

Assessment Appeal Application as a

Yes

No

with the Assessment

Claim for Refund there is no need to

Appeals Board?

file this application.

Step 4:

Reason:

Describe reason for

property tax refund

Attach additional

documents if

necessary

Step 5:

Tax amount

Penalty amount

Redemption penalty amount

Cost amount

Total refund amount

Amount of property

tax refund

Fee amount

Step 6:

I hereby certify and declare under penalty of perjury that the foregoing is true and correct that the tax amount sought to be refunded was

Sign the application

paid within four years prior to filing this demand; that the amounts herein claimed are correct and no part thereof has heretofore been

refunded to this claimant or to any other person for his benefit; and, if acting on behalf of a corporation, that I am duly authorized to act

on their behalf, and that the title shown is true and correct.

Signature

Date

sign

here

Title (If applicable)

If this claim is for a company, the person signing must state their title.

Los Angeles County Auditor-Controller

Step 7:

Property Tax Services Division

Mail application to:

Kenneth Hahn Hall of Administration

500 West Temple Street, Room 153

Los Angeles, CA 90012-3552

Contact Numbers

Customer Service: (213) 974-8368

FAX: (213) 617-0592

Toll free number if calling within Los Angeles County (888) 807-2111

Help Conserve Paper – Print Double-Sided

“To Enrich Lives Through Effective and Caring Service”

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2