Notice Of Change Of Ownership Or Control Form Page 2

ADVERTISEMENT

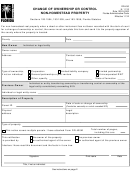

DR-430

N. 1/09

Page 2

Notice of Change of Ownership or Control, Non-Homestead Property

INSTRUCTIONS

Send this form to the property appraiser in the county where the property is located if a deed documenting the

change was not recorded with the county clerk of court.

You do not need to complete Form DR-430 if:

• A deed documenting a change of ownership of the property is recorded with the county clerk of court.

• The transfer corrects an error.

• The transfer is between legal and equitable title.

• The transfer is between husband and wife, including a transfer to a surviving spouse or upon dissolution of

marriage and is a transfer of non-homestead residential property containing nine or fewer dwelling units,

including vacant property zoned and platted for residential use (s. 193.1554, F.S.).

Who Completes a Notice of Change of Ownership or Control Form DR-430?

A change of ownership or control means any sale, foreclosure, transfer of legal title or beneficial title in equity to

any person, or the cumulative transfer of control or of more than 50% of the ownership of the legal entity that

owned the property when it was most recently assessed at just value. A change of control is present when a

change of a director or directors, general partner, or other controlling person or entity to a successor, results in a

transfer of control, or when a lease, contract, or other arrangement transfers control to another person or entity. An

owner of non-homestead property that has changed ownership or control after the January 1 when the property

was most recently assessed at just value is required to notify the property appraiser if the owner:

• Is a person or entity that transfers to another owner or owners, non-homestead property, or control, or a

controlling interest in non-homestead property, or in a legal entity owning such property and retains any

interest;

• Transfers more than 50% ownership interest cumulatively in non-homestead property or in a legal entity

owning the property and retains any ownership;

• Is a transferee of control, or a controlling interest in non-homestead property, or in a legal entity owning the

property, and is also an owner of the property;

• Is a transferee of an ownership interest that together with other ownership interests transferred by the same

owner in non-homestead property or in a legal entity owning the property, adds up to more than 50%; or

• Is a new owner.

The owner must complete a separate Form DR-430 for each parcel of non-homestead property that changed

ownership or control and send the form to the property appraiser in the county where the parcel is located. If one

owner completes and sends a Form DR-430 to the property appraiser, another owner is not required to send an

additional Form DR-430.

If an owner is unsure if there was a cumulative change of ownership or control, the owner, including an owner that

acquires an additional percentage ownership, may check with the previous owner.

Interest and Penalties

An owner who receives an assessment to which they are not entitled is subject to the following:

• Any taxes avoided plus 15% interest each year, and

• A penalty of 50% of the taxes avoided.

Beginning January 1, 2009, the property appraiser is required to record a tax lien on any property owned by a

person or entity that was granted but not entitled to the property assessment limitation under s.193.1554 or

s.193.1555, F.S.

Contact information and mailing addresses for

all Florida property appraisers are on the Department of Revenue’s web site at:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2