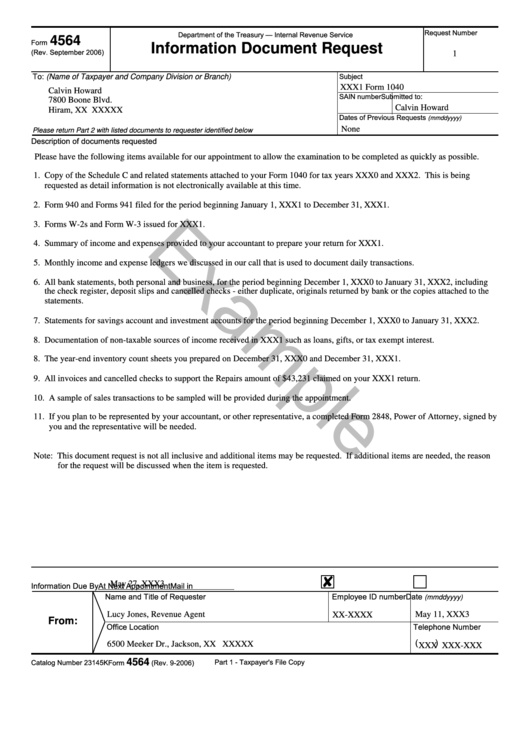

Form 4564 (2006) Information Document Request

ADVERTISEMENT

Request Number

Department of the Treasury — Internal Revenue Service

4564

Form

Information Document Request

(Rev. September 2006)

1

To: (Name of Taxpayer and Company Division or Branch)

Subject

XXX1 Form 1040

Calvin Howard

SAIN number

Submitted to:

7800 Boone Blvd.

Calvin Howard

Hiram, XX XXXXX

Dates of Previous Requests

(mmddyyyy)

None

Please return Part 2 with listed documents to requester identified below

Description of documents requested

Please have the following items available for our appointment to allow the examination to be completed as quickly as possible.

1. Copy of the Schedule C and related statements attached to your Form 1040 for tax years XXX0 and XXX2. This is being

requested as detail information is not electronically available at this time.

2. Form 940 and Forms 941 filed for the period beginning January 1, XXX1 to December 31, XXX1.

3. Forms W-2s and Form W-3 issued for XXX1.

4. Summary of income and expenses provided to your accountant to prepare your return for XXX1.

5. Monthly income and expense ledgers we discussed in our call that is used to document daily transactions.

6. All bank statements, both personal and business, for the period beginning December 1, XXX0 to January 31, XXX2, including

the check register, deposit slips and cancelled checks - either duplicate, originals returned by bank or the copies attached to the

statements.

7. Statements for savings account and investment accounts for the period beginning December 1, XXX0 to January 31, XXX2.

8. Documentation of non-taxable sources of income received in XXX1 such as loans, gifts, or tax exempt interest.

8. The year-end inventory count sheets you prepared on December 31, XXX0 and December 31, XXX1.

9. All invoices and cancelled checks to support the Repairs amount of $43,231 claimed on your XXX1 return.

10. A sample of sales transactions to be sampled will be provided during the appointment.

11. If you plan to be represented by your accountant, or other representative, a completed Form 2848, Power of Attorney, signed by

you and the representative will be needed.

Note: This document request is not all inclusive and additional items may be requested. If additional items are needed, the reason

for the request will be discussed when the item is requested.

Information Due By

May 27, XXX3

At Next Appointment

Mail in

Name and Title of Requester

Employee ID number Date

(mmddyyyy)

Lucy Jones, Revenue Agent

May 11, XXX3

XX-XXXX

From:

Office Location

Telephone Number

(

)

6500 Meeker Dr., Jackson, XX XXXXX

XXX XXX-XXX

Part 1 - Taxpayer's File Copy

Catalog Number 23145K

Form

4564

(Rev. 9-2006)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1