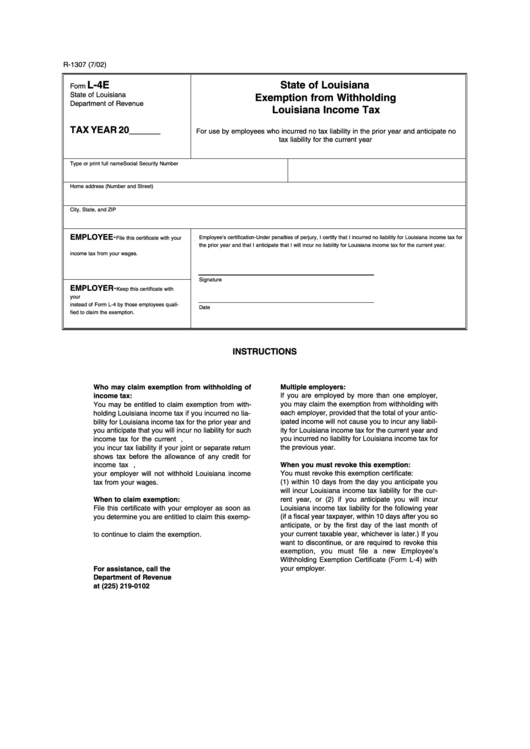

R-1307 (7/02)

L-4E

State of Louisiana

Form

State of Louisiana

Exemption from Withholding

Department of Revenue

Louisiana Income Tax

TAX YEAR 20______

For use by employees who incurred no tax liability in the prior year and anticipate no

tax liability for the current year

Type or print full name

Social Security Number

Home address (Number and Street)

City, State, and ZIP

-

EMPLOYEE

Employee’s certification-Under penalties of perjury, I certify that I incurred no liability for Louisiana income tax for

File this certificate with your

the prior year and that I anticipate that I will incur no liability for Louisiana income tax for the current year.

employer. Otherwise he must withhold Louisiana

income tax from your wages.

Signature

-

EMPLOYER

Keep this certificate with

your records. This certificate may be used

instead of Form L-4 by those employees quali-

Date

fied to claim the exemption.

INSTRUCTIONS

Multiple employers:

Who may claim exemption from withholding of

income tax:

If you are employed by more than one employer,

you may claim the exemption from withholding with

You may be entitled to claim exemption from with-

holding Louisiana income tax if you incurred no lia-

each employer, provided that the total of your antic-

ipated income will not cause you to incur any liabil-

bility for Louisiana income tax for the prior year and

you anticipate that you will incur no liability for such

ity for Louisiana income tax for the current year and

you incurred no liability for Louisiana income tax for

income tax for the current year. For this purpose,

you incur tax liability if your joint or separate return

the previous year.

shows tax before the allowance of any credit for

income tax withheld. If you claim this exemption,

When you must revoke this exemption:

You must revoke this exemption certificate:

your employer will not withhold Louisiana income

(1) within 10 days from the day you anticipate you

tax from your wages.

will incur Louisiana income tax liability for the cur-

rent year, or (2) if you anticipate you will incur

When to claim exemption:

Louisiana income tax liability for the following year

File this certificate with your employer as soon as

(if a fiscal year taxpayer, within 10 days after you so

you determine you are entitled to claim this exemp-

anticipate, or by the first day of the last month of

tion. You must file a certificate each year if you wish

your current taxable year, whichever is later.) If you

to continue to claim the exemption.

want to discontinue, or are required to revoke this

exemption, you must file a new Employee’s

Withholding Exemption Certificate (Form L-4) with

your employer.

For assistance, call the

Department of Revenue

at (225) 219-0102

1

1