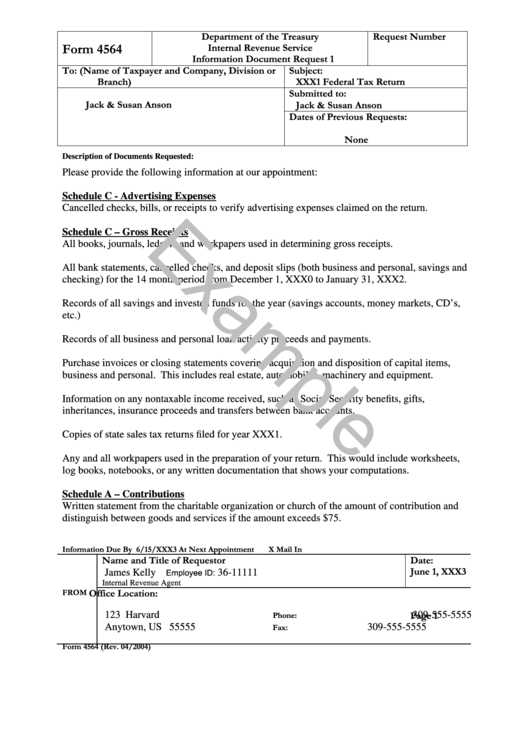

Form 4564 (04/2004) Department Of The Treasury Internal Revenue Service - Information Document Request

ADVERTISEMENT

Department of the Treasury

Request Number

Form 4564

Internal Revenue Service

Information Document Request

1

To: (Name of Taxpayer and Company, Division or

Subject:

Branch)

XXX1 Federal Tax Return

Submitted to:

Jack & Susan Anson

Jack & Susan Anson

Dates of Previous Requests:

None

Description of Documents Requested:

Please provide the following information at our appointment:

Schedule C - Advertising Expenses

Cancelled checks, bills, or receipts to verify advertising expenses claimed on the return.

Schedule C – Gross Receipts

All books, journals, ledgers and workpapers used in determining gross receipts.

All bank statements, cancelled checks, and deposit slips (both business and personal, savings and

checking) for the 14 month period from December 1, XXX0 to January 31, XXX2.

Records of all savings and invested funds for the year (savings accounts, money markets, CD’s,

etc.)

Records of all business and personal loan activity proceeds and payments.

Purchase invoices or closing statements covering acquisition and disposition of capital items,

business and personal. This includes real estate, automobiles, machinery and equipment.

Information on any nontaxable income received, such as Social Security benefits, gifts,

inheritances, insurance proceeds and transfers between bank accounts.

Copies of state sales tax returns filed for year XXX1.

Any and all workpapers used in the preparation of your return. This would include worksheets,

log books, notebooks, or any written documentation that shows your computations.

Schedule A – Contributions

Written statement from the charitable organization or church of the amount of contribution and

distinguish between goods and services if the amount exceeds $75.

Information Due By

6/15/XXX3

At Next Appointment

X

Mail In

Name and Title of Requestor

Date:

June 1, XXX3

Employee ID:

James Kelly

36-11111

Internal Revenue Agent

FROM

Office Location:

Page 1

123 Harvard

Phone:

309-555-5555

Anytown, US 55555

Fax:

309-555-5555

Form 4564 (Rev. 04/2004)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3