Instructions For Form Ftb 3840 - 2016

ADVERTISEMENT

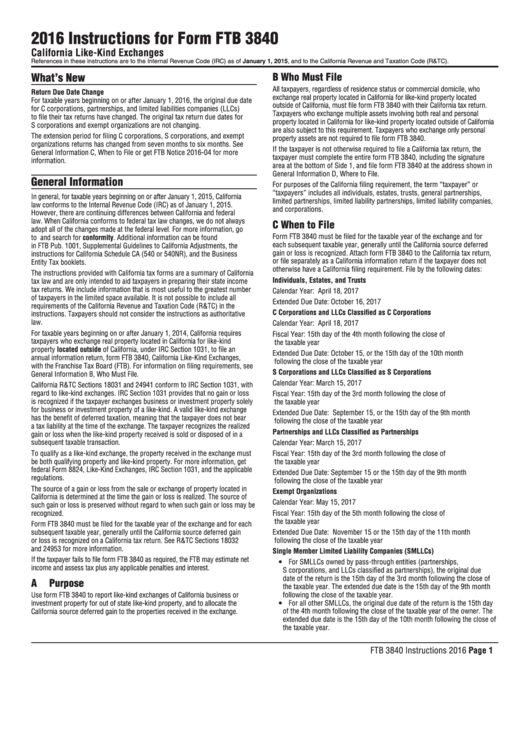

2016 Instructions for Form FTB 3840

California Like-Kind Exchanges

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and to the California Revenue and Taxation Code (R&TC).

What’s New

B

Who Must File

All taxpayers, regardless of residence status or commercial domicile, who

Return Due Date Change

exchange real property located in California for like-kind property located

For taxable years beginning on or after January 1, 2016, the original due date

outside of California, must file form FTB 3840 with their California tax return.

for C corporations, partnerships, and limited liabilities companies (LLCs)

Taxpayers who exchange multiple assets involving both real and personal

to file their tax returns have changed. The original tax return due dates for

property located in California for like-kind property located outside of California

S corporations and exempt organizations are not changing.

are also subject to this requirement. Taxpayers who exchange only personal

The extension period for filing C corporations, S corporations, and exempt

property assets are not required to file form FTB 3840.

organizations returns has changed from seven months to six months. See

If the taxpayer is not otherwise required to file a California tax return, the

General Information C, When to File or get FTB Notice 2016-04 for more

taxpayer must complete the entire form FTB 3840, including the signature

information.

area at the bottom of Side 1, and file form FTB 3840 at the address shown in

General Information D, Where to File.

General Information

For purposes of the California filing requirement, the term “taxpayer” or

“taxpayers” includes all individuals, estates, trusts, general partnerships,

In general, for taxable years beginning on or after January 1, 2015, California

limited partnerships, limited liability partnerships, limited liability companies,

law conforms to the Internal Revenue Code (IRC) as of January 1, 2015.

and corporations.

However, there are continuing differences between California and federal

law. When California conforms to federal tax law changes, we do not always

C

When to File

adopt all of the changes made at the federal level. For more information, go

Form FTB 3840 must be filed for the taxable year of the exchange and for

to ftb.ca.gov and search for conformity. Additional information can be found

each subsequent taxable year, generally until the California source deferred

in FTB Pub. 1001, Supplemental Guidelines to California Adjustments, the

gain or loss is recognized. Attach form FTB 3840 to the California tax return,

instructions for California Schedule CA (540 or 540NR), and the Business

or file separately as a California information return if the taxpayer does not

Entity Tax booklets.

otherwise have a California filing requirement. File by the following dates:

The instructions provided with California tax forms are a summary of California

Individuals, Estates, and Trusts

tax law and are only intended to aid taxpayers in preparing their state income

tax returns. We include information that is most useful to the greatest number

Calendar Year:

April 18, 2017

of taxpayers in the limited space available. It is not possible to include all

Extended Due Date:

October 16, 2017

requirements of the California Revenue and Taxation Code (R&TC) in the

C Corporations and LLCs Classified as C Corporations

instructions. Taxpayers should not consider the instructions as authoritative

law.

Calendar Year:

April 18, 2017

For taxable years beginning on or after January 1, 2014, California requires

Fiscal Year:

15th day of the 4th month following the close of

taxpayers who exchange real property located in California for like-kind

the taxable year

property located outside of California, under IRC Section 1031, to file an

Extended Due Date:

October 15, or the 15th day of the 10th month

annual information return, form FTB 3840, California Like-Kind Exchanges,

following the close of the taxable year

with the Franchise Tax Board (FTB). For information on filing requirements, see

S Corporations and LLCs Classified as S Corporations

General Information B, Who Must File.

Calendar Year:

March 15, 2017

California R&TC Sections 18031 and 24941 conform to IRC Section 1031, with

regard to like-kind exchanges. IRC Section 1031 provides that no gain or loss

Fiscal Year:

15th day of the 3rd month following the close of

is recognized if the taxpayer exchanges business or investment property solely

the taxable year

for business or investment property of a like-kind. A valid like-kind exchange

Extended Due Date:

September 15, or the 15th day of the 9th month

has the benefit of deferred taxation, meaning that the taxpayer does not bear

following the close of the taxable year

a tax liability at the time of the exchange. The taxpayer recognizes the realized

Partnerships and LLCs Classified as Partnerships

gain or loss when the like-kind property received is sold or disposed of in a

subsequent taxable transaction.

Calendar Year:

March 15, 2017

To qualify as a like-kind exchange, the property received in the exchange must

Fiscal Year:

15th day of the 3rd month following the close of

be both qualifying property and like-kind property. For more information, get

the taxable year

federal Form 8824, Like-Kind Exchanges, IRC Section 1031, and the applicable

Extended Due Date:

September 15 or the 15th day of the 9th month

regulations.

following the close of the taxable year

The source of a gain or loss from the sale or exchange of property located in

Exempt Organizations

California is determined at the time the gain or loss is realized. The source of

Calendar Year:

May 15, 2017

such gain or loss is preserved without regard to when such gain or loss may be

recognized.

Fiscal Year:

15th day of the 5th month following the close of

the taxable year

Form FTB 3840 must be filed for the taxable year of the exchange and for each

subsequent taxable year, generally until the California source deferred gain

Extended Due Date:

November 15 or the 15th day of the 11th month

following the close of the taxable year

or loss is recognized on a California tax return. See R&TC Sections 18032

and 24953 for more information.

Single Member Limited Liability Companies (SMLLCs)

If the taxpayer fails to file form FTB 3840 as required, the FTB may estimate net

y For SMLLCs owned by pass-through entities (partnerships,

income and assess tax plus any applicable penalties and interest.

S corporations, and LLCs classified as partnerships), the original due

date of the return is the 15th day of the 3rd month following the close of

A

Purpose

the taxable year. The extended due date is the 15th day of the 9th month

Use form FTB 3840 to report like-kind exchanges of California business or

following the close of the taxable year.

y For all other SMLLCs, the original due date of the return is the 15th day

investment property for out of state like-kind property, and to allocate the

California source deferred gain to the properties received in the exchange.

of the 4th month following the close of the taxable year of the owner. The

extended due date is the 15th day of the 10th month following the close of

the taxable year.

FTB 3840 Instructions 2016 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3