Uscis Form M-736 - Optional Checklist For Form I-129 R-1 Filings

ADVERTISEMENT

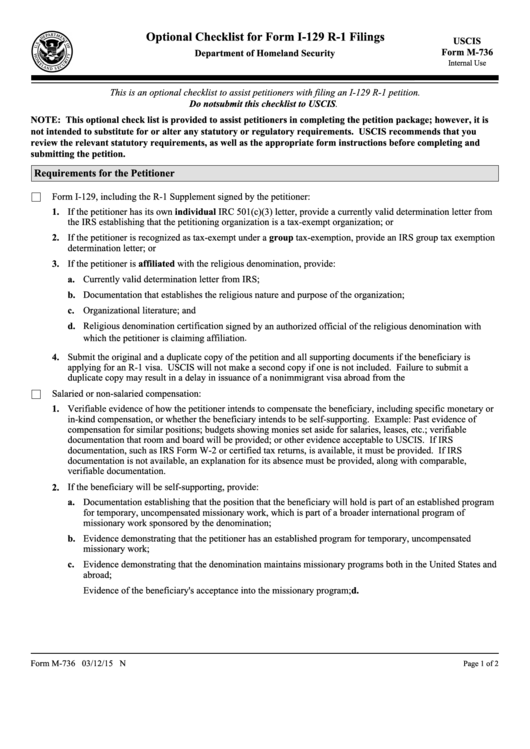

Optional Checklist for Form I-129 R-1 Filings

USCIS

Form M-736

Department of Homeland Security

Internal Use

U.S. Citizenship and Immigration Services

This is an optional checklist to assist petitioners with filing an I-129 R-1 petition.

Do not submit this checklist to USCIS.

NOTE: This optional check list is provided to assist petitioners in completing the petition package; however, it is

not intended to substitute for or alter any statutory or regulatory requirements. USCIS recommends that you

review the relevant statutory requirements, as well as the appropriate form instructions before completing and

submitting the petition.

Requirements for the Petitioner

Form I-129, including the R-1 Supplement signed by the petitioner:

1.

If the petitioner has its own individual IRC 501(c)(3) letter, provide a currently valid determination letter from

the IRS establishing that the petitioning organization is a tax-exempt organization; or

2.

If the petitioner is recognized as tax-exempt under a group tax-exemption, provide an IRS group tax exemption

determination letter; or

3.

If the petitioner is affiliated with the religious denomination, provide:

a.

Currently valid determination letter from IRS;

b.

Documentation that establishes the religious nature and purpose of the organization;

c.

Organizational literature; and

d.

Religious denomination certification signed by an authorized official of the religious denomination with

which the petitioner is claiming affiliation .

4.

Submit the original and a duplicate copy of the petition and all supporting documents if the beneficiary is

applying for an R-1 visa. USCIS will not make a second copy if one is not included. Failure to submit a

duplicate copy may result in a delay in issuance of a nonimmigrant visa abroad from the U.S. Department of State.

Salaried or non-salaried compensation:

1.

Verifiable evidence of how the petitioner intends to compensate the beneficiary, including specific monetary or

in-kind compensation, or whether the beneficiary intends to be self-supporting. Example: Past evidence of

compensation for similar positions; budgets showing monies set aside for salaries, leases, etc.; verifiable

documentation that room and board will be provided; or other evidence acceptable to USCIS. If IRS

documentation, such as IRS Form W-2 or certified tax returns, is available, it must be provided. If IRS

documentation is not available, an explanation for its absence must be provided, along with comparable,

verifiable documentation.

2.

If the beneficiary will be self-supporting, provide:

a.

Documentation establishing that the position that the beneficiary will hold is part of an established program

for temporary, uncompensated missionary work, which is part of a broader international program of

missionary work sponsored by the denomination;

b.

Evidence demonstrating that the petitioner has an established program for temporary, uncompensated

missionary work;

c.

Evidence demonstrating that the denomination maintains missionary programs both in the United States and

abroad;

d.

Evidence of the beneficiary's acceptance into the missionary program;

Form M-736 03/12/15 N

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2