Request For Irs Form W-2

Download a blank fillable Request For Irs Form W-2 in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Request For Irs Form W-2 with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

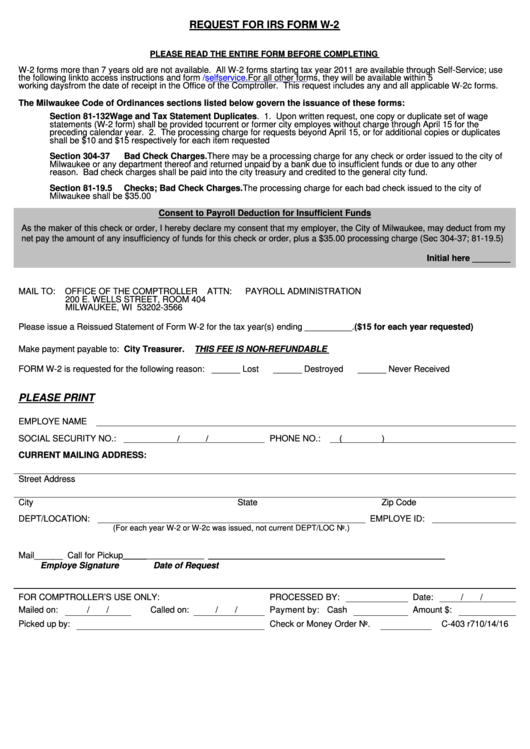

REQUEST FOR IRS FORM W-2

PLEASE READ THE ENTIRE FORM BEFORE COMPLETING

W-2 forms more than 7 years old are not available. All W-2 forms starting tax year 2011 are available through Self-Service; use

the following link to access instructions and form milwaukee.gov/selfservice. For all other forms, they will be available within 5

working days from the date of receipt in the Office of the Comptroller. This request includes any and all applicable W-2c forms.

The Milwaukee Code of Ordinances sections listed below govern the issuance of these forms:

Section 81-132

Wage and Tax Statement Duplicates. 1. Upon written request, one copy or duplicate set of wage

statements (W-2 form) shall be provided to current or former city employes without charge through April 15 for the

preceding calendar year. 2. The processing charge for requests beyond April 15, or for additional copies or duplicates

shall be $10 and $15 respectively for each item requested

Section 304-37

Bad Check Charges. There may be a processing charge for any check or order issued to the city of

Milwaukee or any department thereof and returned unpaid by a bank due to insufficient funds or due to any other

reason. Bad check charges shall be paid into the city treasury and credited to the general city fund.

Section 81-19.5

Checks; Bad Check Charges. The processing charge for each bad check issued to the city of

Milwaukee shall be $35.00

Consent to Payroll Deduction for Insufficient Funds

As the maker of this check or order, I hereby declare my consent that my employer, the City of Milwaukee, may deduct from my

net pay the amount of any insufficiency of funds for this check or order, plus a $35.00 processing charge (Sec 304-37; 81-19.5)

Initial here ________

MAIL TO:

OFFICE OF THE COMPTROLLER

ATTN:

PAYROLL ADMINISTRATION

200 E. WELLS STREET, ROOM 404

MILWAUKEE, WI 53202-3566

Please issue a Reissued Statement of Form W-2 for the tax year(s) ending __________. ($15 for each year requested)

Make payment payable to: City Treasurer.

THIS FEE IS NON-REFUNDABLE

FORM W-2 is requested for the following reason: ______ Lost

______ Destroyed

______ Never Received

PLEASE PRINT

EMPLOYE NAME

SOCIAL SECURITY NO.:

PHONE NO.:

(

)

/

/

CURRENT MAILING ADDRESS:

Street Address

City

State

Zip Code

DEPT/LOCATION:

EMPLOYE ID:

(For each year W-2 or W-2c was issued, not current DEPT/LOC No.)

Mail ______ Call for Pickup __________________

__________________________________________________

Employe Signature

Date of Request

FOR COMPTROLLER’S USE ONLY:

PROCESSED BY:

Date:

/

/

Mailed on:

/

/

Called on:

/

/

Payment by:

Cash

Amount $:

Picked up by:

Check or Money Order No.

C-403 r7 10/14/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1