Form Va-4 - Personal Exemption Worksheet

ADVERTISEMENT

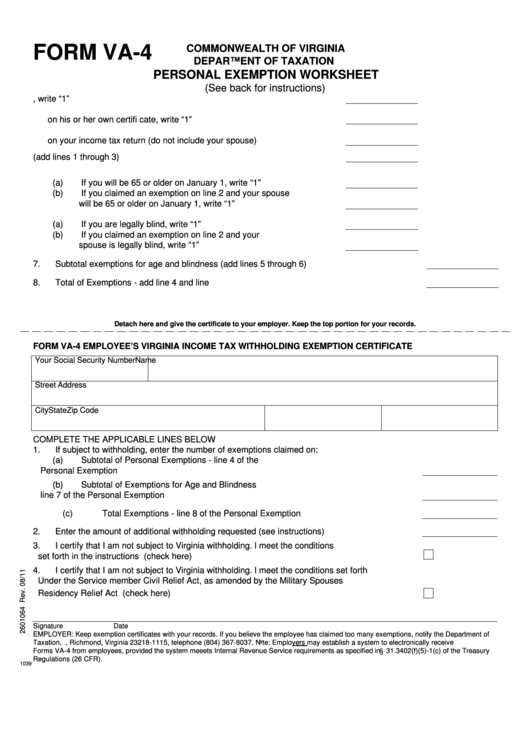

FORM VA-4

COMMONWEALTH OF VIRGINIA

DEPARTMENT OF TAXATION

PERSONAL EXEMPTION WORKSHEET

(See back for instructions)

1. If you wish to claim yourself, write “1” ..............................................................

2. If you are married and your spouse is not claimed

on his or her own certifi cate, write “1” ...............................................................

3. Write the number of dependents you will be allowed to claim

on your income tax return (do not include your spouse) ...................................

4. Subtotal Personal Exemptions (add lines 1 through 3) .....................................

5. Exemptions for age

(a)

If you will be 65 or older on January 1, write “1” ..................................

(b)

If you claimed an exemption on line 2 and your spouse

will be 65 or older on January 1, write “1” ............................................

6. Exemptions for blindness

(a)

If you are legally blind, write “1” ...........................................................

(b)

If you claimed an exemption on line 2 and your

spouse is legally blind, write “1” ...........................................................

7. Subtotal exemptions for age and blindness (add lines 5 through 6) ...................................................

8. Total of Exemptions - add line 4 and line 7 .........................................................................................

Detach here and give the certificate to your employer. Keep the top portion for your records.

FORM VA-4

EMPLOYEE’S VIRGINIA INCOME TAX WITHHOLDING EXEMPTION CERTIFICATE

Your Social Security Number

Name

Street Address

City

State

Zip Code

COMPLETE THE APPLICABLE LINES BELOW

1. If subject to withholding, enter the number of exemptions claimed on:

(a)

Subtotal of Personal Exemptions - line 4 of the

Personal Exemption Worksheet...........................................................................................

(b)

Subtotal of Exemptions for Age and Blindness

line 7 of the Personal Exemption Worksheet .......................................................................

(c)

Total Exemptions - line 8 of the Personal Exemption Worksheet.........................................

2. Enter the amount of additional withholding requested (see instructions)..........................................

3. I certify that I am not subject to Virginia withholding. l meet the conditions

set forth in the instructions ................................................................................. (check here)

4. I certify that I am not subject to Virginia withholding. l meet the conditions set forth

Under the Service member Civil Relief Act, as amended by the Military Spouses

Residency Relief Act .......................................................................................... (check here)

Signature

Date

EMPLOYER: Keep exemption certificates with your records. If you believe the employee has claimed too many exemptions, notify the Department of

Taxation, P.O. Box 1115, Richmond, Virginia 23218-1115, telephone (804) 367-8037. Note: Employers may establish a system to electronically receive

Forms VA-4 from employees, provided the system meeets Internal Revenue Service requirements as specified in 31.3402(f)(5)-1(c) of the Treasury

Regulations (26 CFR).

1039

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2