Schedule J Foreign Dividends

Download a blank fillable Schedule J Foreign Dividends in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Schedule J Foreign Dividends with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

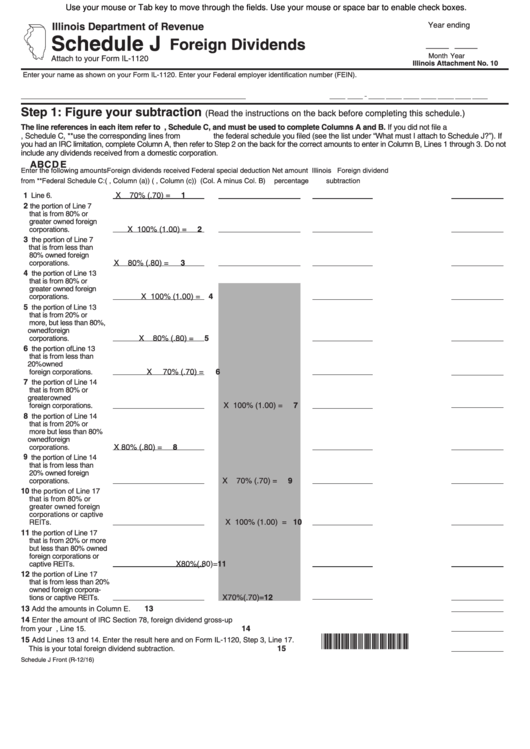

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Year ending

Illinois Department of Revenue

Schedule J

Foreign Dividends

____ ____

Month

Year

Attach to your Form IL-1120

Illinois Attachment No. 10

Enter your name as shown on your Form IL-1120.

Enter your Federal employer identification number (FEIN).

Step 1: Figure your subtraction

(Read the instructions on the back before completing this schedule.)

The line references in each item refer to U.S. 1120, Schedule C, and must be used to complete Columns A and B. If you did not file a

U.S. 1120, Schedule C, **use the corresponding lines from the federal schedule you filed (see the list under “What must I attach to Schedule J?”). If

you had an IRC limitation, complete Column A, then refer to Step 2 on the back for the correct amounts to enter in Column B, Lines 1 through 3. Do not

include any dividends received from a domestic corporation.

A

B

C

D

E

Enter the following amounts

Foreign dividends received

Federal special deduction

Net amount

Illinois

Foreign dividend

from **Federal Schedule C: (U.S. Schedule C, Column (a))

(U.S. Schedule C, Column (c)) (Col. A minus Col. B)

percentage

subtraction

1

X

70% (.70) =

1

Line 6.

2

the portion of Line 7

that is from 80% or

greater owned foreign

2

corporations.

X 100% (1.00) =

3

the portion of Line 7

that is from less than

80% owned foreign

X

80% (.80) =

3

corporations.

4

the portion of Line 13

that is from 80% or

greater owned foreign

4

X 100% (1.00) =

corporations.

5

he portion of Line 13

t

that is from 20% or

more, but less than 80%,

owned foreign

X

80% (.80) =

5

corporations.

6

the portion of Line 13

that is from less than

20% owned

6

X

70% (.70) =

foreign corporations.

7

the portion of Line 14

that is from 80% or

greater owned

X 100% (1.00) =

7

foreign corporations.

8

the portion of Line 14

that is from 20% or

more but less than 80%

owned foreign

8

X

80% (.80) =

corporations.

9

the portion of Line 14

that is from less than

20% owned foreign

X

70% (.70) =

9

corporations.

10

the portion of Line 17

that is from 80% or

greater owned foreign

corporations or captive

X 100% (1.00) = 10

REITs.

11

the portion of Line 17

that is from 20% or more

but less than 80% owned

foreign corporations or

X

80% (.80) = 11

captive REITs.

12

the portion of Line 17

that is from less than 20%

owned foreign corpora-

X

70% (.70) = 12

tions or captive REITs.

13

13

Add the amounts in Column E.

14

Enter the amount of IRC Section 78, foreign dividend gross-up

14

from your U.S. Schedule C, Line 15.

*163370001*

15

Add Lines 13 and 14. Enter the result here and on Form IL-1120, Step 3, Line 17.

15

This is your total foreign dividend subtraction.

Schedule J Front (R-12/16)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2