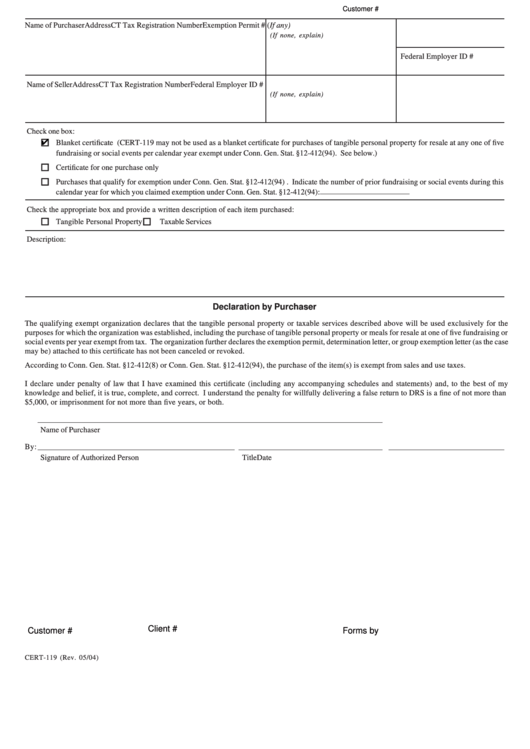

Customer #

Name of Purchaser

Address

CT Tax Registration Number

Exemption Permit # (If any)

(If none, explain)

Federal Employer ID #

Name of Seller

Address

CT Tax Registration Number

Federal Employer ID #

(If none, explain)

Check one box:

Blanket certificate (CERT-119 may not be used as a blanket certificate for purchases of tangible personal property for resale at any one of five

fundraising or social events per calendar year exempt under Conn. Gen. Stat. §12-412(94). See below.)

Certificate for one purchase only

Purchases that qualify for exemption under Conn. Gen. Stat. §12-412(94) . Indicate the number of prior fundraising or social events during this

calendar year for which you claimed exemption under Conn. Gen. Stat. §12-412(94): _______________________

Check the appropriate box and provide a written description of each item purchased:

Tangible Personal Property

Taxable Services

Description:

Declaration by Purchaser

The qualifying exempt organization declares that the tangible personal property or taxable services described above will be used exclusively for the

purposes for which the organization was established, including the purchase of tangible personal property or meals for resale at one of five fundraising or

social events per year exempt from tax. The organization further declares the exemption permit, determination letter, or group exemption letter (as the case

may be) attached to this certificate has not been canceled or revoked.

According to Conn. Gen. Stat. §12-412(8) or Conn. Gen. Stat. §12-412(94), the purchase of the item(s) is exempt from sales and use taxes.

I declare under penalty of law that I have examined this certificate (including any accompanying schedules and statements) and, to the best of my

knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return to DRS is a fine of not more than

$5,000, or imprisonment for not more than five years, or both.

Name of Purchaser

By:

Signature of Authorized Person

Title

Date

Client #

Customer #

Forms by

CERT-119 (Rev. 05/04)

1

1