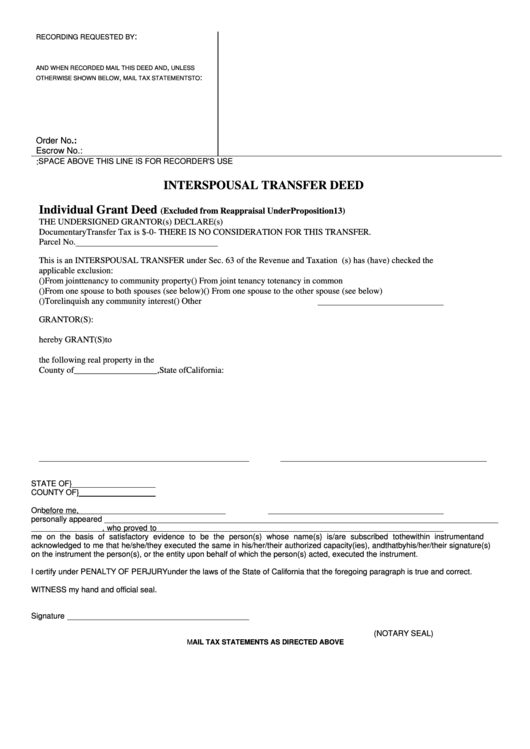

Interspousal Transfer Deed Form

ADVERTISEMENT

:

RECORDING REQUESTED BY

,

AND WHEN RECORDED MAIL THIS DEED AND

UNLESS

,

:

OTHERWISE SHOWN BELOW

MAIL TAX STATEMENTS TO

Order No.:

Escrow No.:

SPACE ABOVE THIS LINE IS FOR RECORDER'S USE

A.P.N.:

INTERSPOUSAL TRANSFER DEED

Individual Grant Deed

(Excluded from Reappraisal Under Proposition 13)

THE UNDERSIGNED GRANTOR(s) DECLARE(s)

Documentary Transfer Tax is $-0- THERE IS NO CONSIDERATION FOR THIS TRANSFER.

Parcel No.

This is an INTERSPOUSAL TRANSFER under Sec. 63 of the Revenue and Taxation Code. Grantee(s) has (have) checked the

applicable exclusion:

( )

From joint tenancy to community property

( ) From joint tenancy to tenancy in common

( )

From one spouse to both spouses (see below)

( ) From one spouse to the other spouse (see below)

( )

To relinquish any community interest

( ) Other

GRANTOR(S):

hereby GRANT(S) to

the following real property in the

County of___________________, State of California:

STATE OF

}

COUNTY OF

}

On

before me,

personally appeared

, who proved to

me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and

acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s)

on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

I certify under PENALTY OF PERJURY under the laws of the State of California that the foregoing paragraph is true and correct.

WITNESS my hand and official seal.

Signature

(NOTARY SEAL)

MAIL TAX STATEMENTS AS DIRECTED ABOVE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1