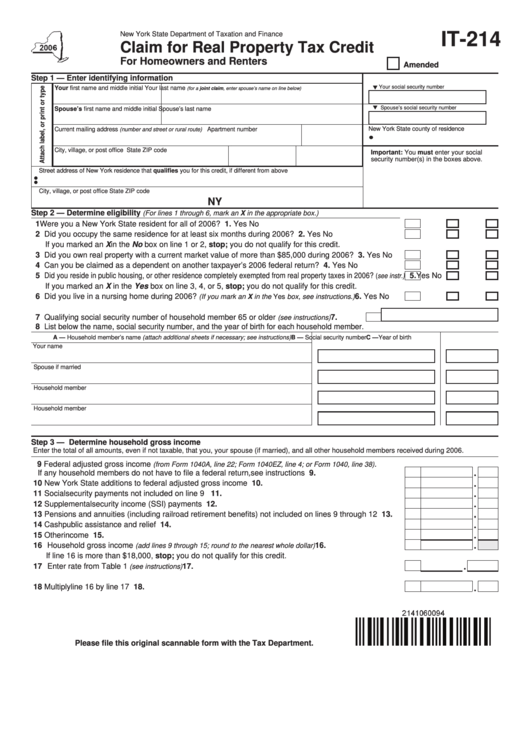

New York State Department of Taxation and Finance

IT-214

Claim for Real Property Tax Credit

For Homeowners and Renters

Amended

Step 1 — Enter identifying information

Your social security number

Your first name and middle initial

Your last name

(for a joint claim, enter spouse’s name on line below)

Spouse’s social security number

Spouse’s first name and middle initial Spouse’s last name

New York State county of residence

Current mailing address

Apartment number

(number and street or rural route)

City, village, or post office

State

ZIP code

Important: You must enter your social

security number(s) in the boxes above.

Street address of New York residence that qualifies you for this credit, if different from above

City, village, or post office

State

ZIP code

NY

Step 2 — Determine eligibility

(For lines 1 through 6, mark an X in the appropriate box.)

1 Were you a New York State resident for all of 2006? . .................................................................................. 1.

Yes

No

2 Did you occupy the same residence for at least six months during 2006? . ................................................. 2.

Yes

No

If you marked an X in the No box on line 1 or 2, stop; you do not qualify for this credit.

3 Did you own real property with a current market value of more than $85,000 during 2006? ...................... 3.

Yes

No

4 Can you be claimed as a dependent on another taxpayer’s 2006 federal return? ...................................... 4.

Yes

No

5 Did you reside in public housing, or other residence completely exempted from real property taxes in 2006?

5.

Yes

No

(see instr.)

If you marked an X in the Yes box on line 3, 4, or 5, stop; you do not qualify for this credit.

6 Did you live in a nursing home during 2006?

. ...................... 6.

Yes

No

(If you mark an X in the Yes box, see instructions.)

7 Qualifying social security number of household member 65 or older

.............. 7.

(see instructions)

8 List below the name, social security number, and the year of birth for each household member.

A — Household member’s name (attach additional sheets if necessary; see instructions)

B — Social security number

C —Year of birth

Your name

Spouse if married

Household member

Household member

Step 3 — Determine household gross income

Enter the total of all amounts, even if not taxable, that you, your spouse (if married), and all other household members received during 2006.

9 Federal adjusted gross income

.

(from Form 1040A, line 22; Form 1040EZ, line 4; or Form 1040, line 38)

If any household members do not have to file a federal return, see instructions . ...................................

9.

10 New York State additions to federal adjusted gross income ....................................................................... 10.

11 Social security payments not included on line 9 . ....................................................................................... 11.

12 Supplemental security income (SSI) payments . ......................................................................................... 12.

13 Pensions and annuities (including railroad retirement benefits) not included on lines 9 through 12 .......... 13.

14 Cash public assistance and relief . .............................................................................................................. 14.

15 Other income . ............................................................................................................................................. 15.

16 Household gross income

. ........................................ 16.

(add lines 9 through 15; round to the nearest whole dollar)

If line 16 is more than $18,000, stop; you do not qualify for this credit.

17 Enter rate from Table 1

. ..................................................................................................... 17.

(see instructions)

18 Multiply line 16 by line 17 ........................................................................................................................... 18.

Please file this original scannable form with the Tax Department.

1

1 2

2