How To Fill Out The Federal Form 8843

ADVERTISEMENT

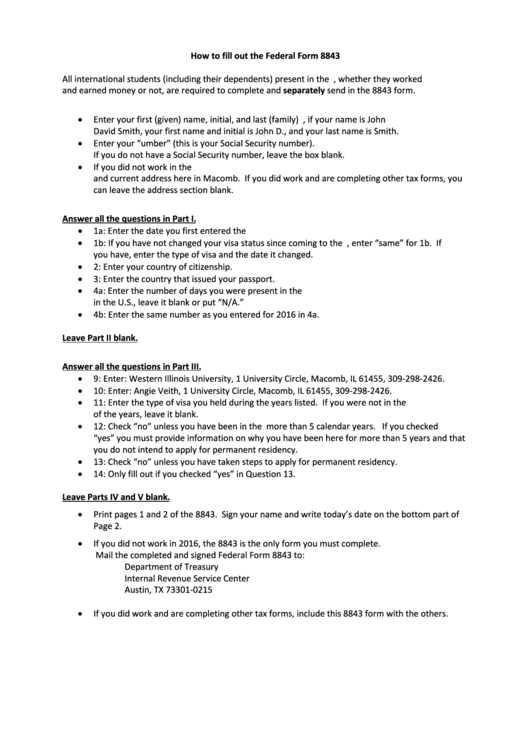

How to fill out the Federal Form 8843

All international students (including their dependents) present in the U.S. in 2016, whether they worked

and earned money or not, are required to complete and separately send in the 8843 form.

Enter your first (given) name, initial, and last (family) name. For example, if your name is John

David Smith, your first name and initial is John D., and your last name is Smith.

Enter your “U.S. taxpayer identification number” (this is your Social Security number).

If you do not have a Social Security number, leave the box blank.

If you did not work in the U.S. in 2016 you must enter your addresses in both your home country

and current address here in Macomb. If you did work and are completing other tax forms, you

can leave the address section blank.

Answer all the questions in Part I.

1a: Enter the date you first entered the U.S. and the type of visa you had.

1b: If you have not changed your visa status since coming to the U.S., enter “same” for 1b. If

you have, enter the type of visa and the date it changed.

2: Enter your country of citizenship.

3: Enter the country that issued your passport.

4a: Enter the number of days you were present in the U.S. for the years listed. If you were not

in the U.S., leave it blank or put “N/A.”

4b: Enter the same number as you entered for 2016 in 4a.

Leave Part II blank.

Answer all the questions in Part III.

9: Enter: Western Illinois University, 1 University Circle, Macomb, IL 61455, 309-298-2426.

10: Enter: Angie Veith, 1 University Circle, Macomb, IL 61455, 309-298-2426.

11: Enter the type of visa you held during the years listed. If you were not in the U.S. during one

of the years, leave it blank.

12: Check “no” unless you have been in the U.S. more than 5 calendar years. If you checked

“yes” you must provide information on why you have been here for more than 5 years and that

you do not intend to apply for permanent residency.

13: Check “no” unless you have taken steps to apply for permanent residency.

14: Only fill out if you checked “yes” in Question 13.

Leave Parts IV and V blank.

Print pages 1 and 2 of the 8843. Sign your name and write today’s date on the bottom part of

Page 2.

If you did not work in 2016, the 8843 is the only form you must complete.

Mail the completed and signed Federal Form 8843 to:

Department of Treasury

Internal Revenue Service Center

Austin, TX 73301-0215

If you did work and are completing other tax forms, include this 8843 form with the others.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1