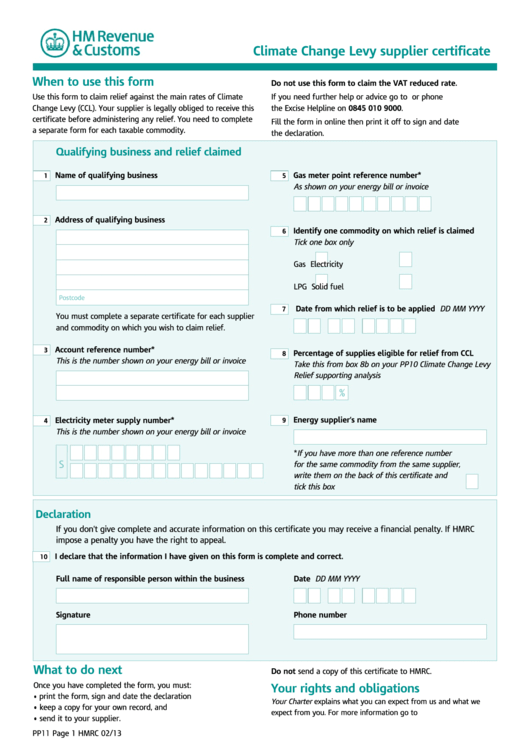

Climate Change Levy supplier certificate

When to use this form

Do not use this form to claim the VAT reduced rate.

Use this form to claim relief against the main rates of Climate

If you need further help or advice go to hmrc.gov.uk or phone

Change Levy (CCL). Your supplier is legally obliged to receive this

the Excise Helpline on 0845 010 9000.

certificate before administering any relief. You need to complete

Fill the form in online then print it off to sign and date

a separate form for each taxable commodity.

the declaration.

Qualifying business and relief claimed

Name of qualifying business

Gas meter point reference number*

1

5

As shown on your energy bill or invoice

Address of qualifying business

2

Identify one commodity on which relief is claimed

6

Tick one box only

Gas

Electricity

LPG

Solid fuel

Postcode

Date from which relief is to be applied DD MM YYYY

7

You must complete a separate certificate for each supplier

and commodity on which you wish to claim relief.

Account reference number*

3

Percentage of supplies eligible for relief from CCL

8

This is the number shown on your energy bill or invoice

Take this from box 8b on your PP10 Climate Change Levy

Relief supporting analysis

%

Energy supplier’s name

Electricity meter supply number*

9

4

This is the number shown on your energy bill or invoice

*If you have more than one reference number

S

for the same commodity from the same supplier,

write them on the back of this certificate and

tick this box

Declaration

If you don’t give complete and accurate information on this certificate you may receive a financial penalty. If HMRC

impose a penalty you have the right to appeal.

I declare that the information I have given on this form is complete and correct.

10

Full name of responsible person within the business

Date DD MM YYYY

Signature

Phone number

What to do next

Do not send a copy of this certificate to HMRC.

Once you have completed the form, you must:

Your rights and obligations

• print the form, sign and date the declaration

Your Charter explains what you can expect from us and what we

•

keep a copy for your own record, and

expect from you. For more information go to hmrc.gov.uk/charter

•

send it to your supplier.

PP11

Page 1

HMRC 02/13

1

1