Clear Form

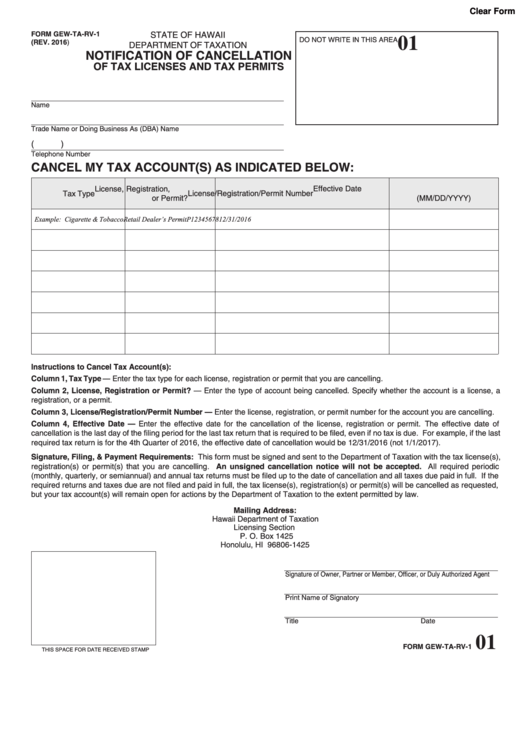

FORM GEW-TA-RV-1

01

STATE OF HAWAII

DO NOT WRITE IN THIS AREA

(REV. 2016)

DEPARTMENT OF TAXATION

NOTIFICATION OF CANCELLATION

OF TAX LICENSES AND TAX PERMITS

Name

Trade Name or Doing Business As (DBA) Name

(

)

Telephone Number

CANCEL MY TAX ACCOUNT(S) AS INDICATED BELOW:

License, Registration,

Effective Date

Tax Type

License/Registration/Permit Number

or Permit?

(MM/DD/YYYY)

Example: Cigarette & Tobacco

Retail Dealer’s Permit

P12345678

12/31/2016

Instructions to Cancel Tax Account(s):

Column 1, Tax Type — Enter the tax type for each license, registration or permit that you are cancelling.

Column 2, License, Registration or Permit? — Enter the type of account being cancelled. Specify whether the account is a license, a

registration, or a permit.

Column 3, License/Registration/Permit Number — Enter the license, registration, or permit number for the account you are cancelling.

Column 4, Effective Date — Enter the effective date for the cancellation of the license, registration or permit. The effective date of

cancellation is the last day of the filing period for the last tax return that is required to be filed, even if no tax is due. For example, if the last

required tax return is for the 4th Quarter of 2016, the effective date of cancellation would be 12/31/2016 (not 1/1/2017).

Signature, Filing, & Payment Requirements: This form must be signed and sent to the Department of Taxation with the tax license(s),

registration(s) or permit(s) that you are cancelling. An unsigned cancellation notice will not be accepted. All required periodic

(monthly, quarterly, or semiannual) and annual tax returns must be filed up to the date of cancellation and all taxes due paid in full. If the

required returns and taxes due are not filed and paid in full, the tax license(s), registration(s) or permit(s) will be cancelled as requested,

but your tax account(s) will remain open for actions by the Department of Taxation to the extent permitted by law.

Mailing Address:

Hawaii Department of Taxation

Licensing Section

P. O. Box 1425

Honolulu, HI 96806-1425

Signature of Owner, Partner or Member, Officer, or Duly Authorized Agent

Print Name of Signatory

Title

Date

01

FORM GEW-TA-RV-1

THIS SPACE FOR DATE RECEIVED STAMP

1

1