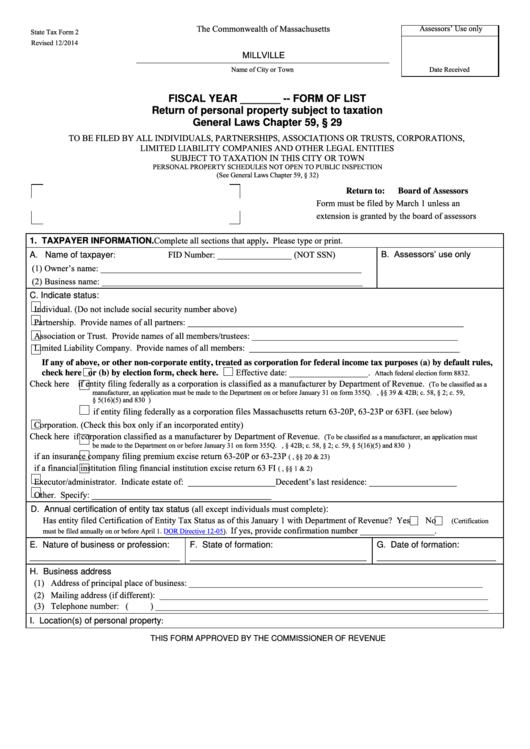

The Commonwealth of Massachusetts

Assessors’ Use only

State Tax Form 2

Revised 12/2014

MILLVILLE

Name of City or Town

Date Received

FISCAL YEAR _______ -- FORM OF LIST

Return of personal property subject to taxation

General Laws Chapter 59, § 29

TO BE FILED BY ALL INDIVIDUALS, PARTNERSHIPS, ASSOCIATIONS OR TRUSTS, CORPORATIONS,

LIMITED LIABILITY COMPANIES AND OTHER LEGAL ENTITIES

SUBJECT TO TAXATION IN THIS CITY OR TOWN

PERSONAL PROPERTY SCHEDULES NOT OPEN TO PUBLIC INSPECTION

(See General Laws Chapter 59, § 32)

Return to:

Board of Assessors

Form must be filed by March 1 unless an

extension is granted by the board of assessors

1. TAXPAYER INFORMATION. Complete all sections that apply. Please type or print.

FID Number: _________________ (NOT SSN)

B. Assessors’ use only

A. Name of taxpayer:

(1) Owner’s name: ___________________________________________________________

(2) Business name: ___________________________________________________________

C. Indicate status:

Individual. (Do not include social security number above)

Partnership. Provide names of all partners: _______________________________________________________________

Association or Trust. Provide names of all members/trustees: _______________________________________________

Limited Liability Company. Provide names of all members: ________________________________________________

If any of above, or other non-corporate entity, treated as corporation for federal income tax purposes (a) by default rules,

Effective date: __________________.

Attach federal election form 8832.

check here

or (b) by election form, check here.

Check here

if entity filing federally as a corporation is classified as a manufacturer by Department of Revenue.

(To be classified as a

manufacturer, an application must be made to the Department on or before January 31 on form 355Q. G.L. c. 63, §§ 39 & 42B; c. 58, § 2; c. 59,

§ 5(16)(5) and 830 C.M.R. 58.2.1)

if entity filing federally as a corporation files Massachusetts return 63-20P, 63-23P or 63FI.

(see below)

Corporation. (Check this box only if an incorporated entity)

Check here

if corporation classified as a manufacturer by Department of Revenue.

(To be classified as a manufacturer, an application must

be made to the Department on or before January 31 on form 355Q. G.L. c. 63, § 42B; c. 58, § 2; c. 59, § 5(16)(5) and 830 C.M.R. 58.2.1)

if an insurance company filing premium excise return 63-20P or 63-23P

(G.L. c. 63, §§ 20 & 23)

if a financial institution filing financial institution excise return 63 FI

(G.L. c. 63, §§ 1 & 2)

Executor/administrator. Indicate estate of: ____________________ Decedent’s last residence: ____________________

Other. Specify: _________________________________________

D. Annual certification of entity tax status (all except individuals must complete):

Has entity filed Certification of Entity Tax Status as of this January 1 with Department of Revenue? Yes

No

(Certification

If yes, provide confirmation number _________________.

must be filed annually on or before April 1.

DOR Directive

12-05).

E. Nature of business or profession:

F. State of formation:

G. Date of formation:

__________________________________

________________________________________

___________________________

H. Business address

(1) Address of principal place of business: ___________________________________________________________________

(2) Mailing address (if different): ___________________________________________________________________________

(3) Telephone number: (

) ____________________________________________________________________________

I. Location(s) of personal property:

THIS FORM APPROVED BY THE COMMISSIONER OF REVENUE

1

1 2

2 3

3 4

4